Loading

Get Nc Dor D-403 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-403 online

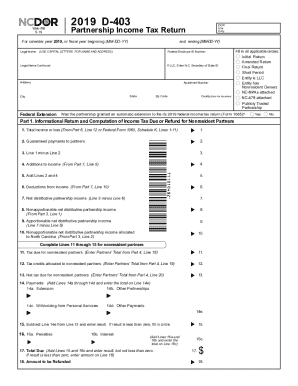

This guide provides comprehensive, step-by-step instructions for completing the NC DoR D-403 form online. Whether you are a partnership or a nonresident partner, following these instructions will help ensure accurate submission.

Follow the steps to complete the NC DoR D-403 online efficiently.

- Click ‘Get Form’ button to open the NC DoR D-403 form in the online editor.

- Fill in the legal name of the entity as well as the federal employer identification number using capital letters. Ensure that all address details are filled in, including the apartment number, state, city, zip code, and county.

- Choose the appropriate box(es) based on the type of return being submitted: initial, amended, final, or short period. Indicate whether the entity is an LLC, if it has nonresident owners, and if certain forms such as NC-NPAs or NC-478 are attached.

- Indicate whether the partnership received an automatic extension for filing the 2019 federal income tax return.

- Proceed to Part 1 of the form. Enter the total income or loss from the relevant schedules and compute guaranteed payments. Subtract the guaranteed payments from total income to derive the net distributive partnership income.

- Complete the necessary lines regarding additions to income, deductions from income, and any nonapportionable income if applicable.

- In Part 2, if applicable, compute the apportionment percentage for partnerships with nonresident partners, ensuring to enter the correct gross amounts and apportionment factors.

- For Part 3, fill in details for nonapportionable net distributive partnership income, explaining why the income is classified as nonapportionable.

- In Part 4, provide the shares of income, adjustments, and tax credits for all partners. Include necessary computations for nonresident partners.

- Continue filling out Parts 5 through 7, detailing ordinary business income, partners' distributive share items, and any adjustments to income.

- Finally, review all entered information for accuracy, sign the document, and submit the form as instructed. At this stage, users can save changes, download, print, or share the completed form.

Complete your NC DoR D-403 online now for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Select 'File & Pay'. Scroll down to the 'Commonly Filed Taxes' section. Select the type of tax you are paying ... Complete your contact information, click next. Complete your tax payment information, click next.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.