Loading

Get Id St-104-hm 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID ST-104-HM online

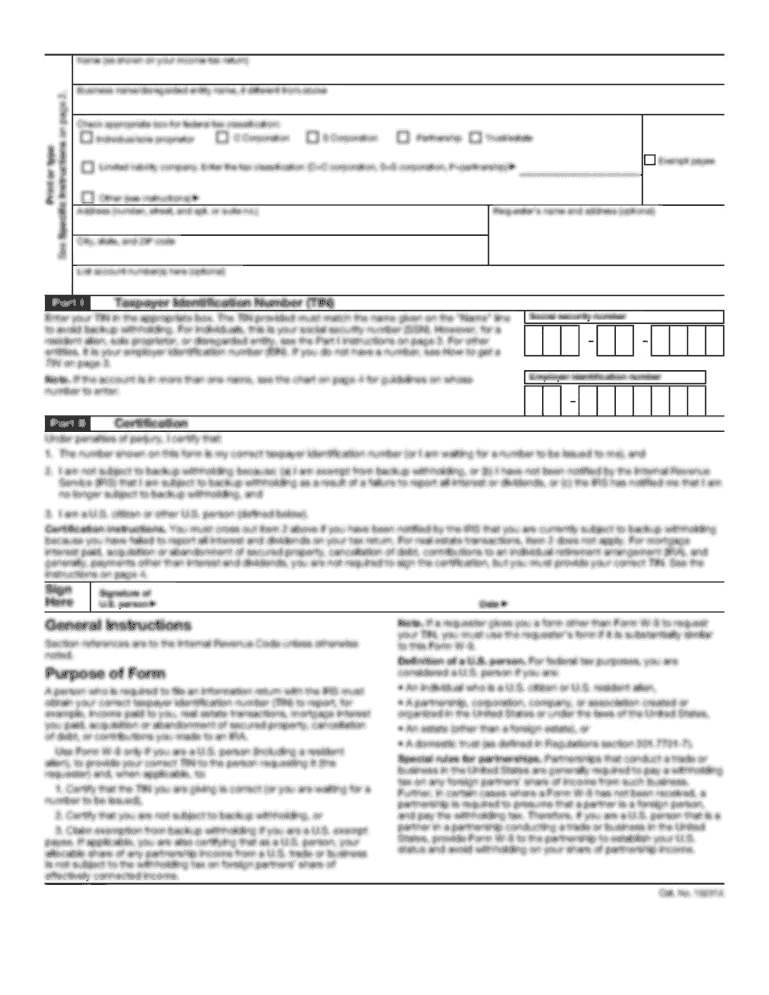

The ID ST-104-HM form is essential for U.S. government employees and certain organizations claiming tax exemptions on lodging accommodations. This guide offers step-by-step instructions for completing the form online, ensuring you understand each section clearly.

Follow the steps to effectively complete the ID ST-104-HM form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter your name in the 'Guest Name' field.

- Fill in the 'Lodging Provider Name (Seller)' section with the name of the lodging company.

- Provide the address of the lodging provider, including the street address, city, state, and ZIP code.

- If applicable, enter the address of your organization in the subsequent address fields.

- Select the appropriate category that applies to you — either U.S. government, Idaho state government, or Idaho local government/qualified organization.

- For U.S. government employees, specify your agency name and select the corresponding GSA SmartPay method. Enter only the relevant part of your credit card number in the designated blanks.

- Idaho state government employees should provide their agency name and enter their qualifying credit card number in the available field.

- If you are from a local government or qualified organization, type your organization’s name, choose your type of card, and enter the credit card number accordingly.

- Sign the form to certify the information provided is accurate. Include your driver’s license number, work phone number, and date of completion.

- After completing the form, you can save your changes, download, print, or share the document as needed.

Complete your ID ST-104-HM form online today to ensure you receive your tax exemption on lodging accommodations.

Part-year residents must file an Idaho income tax return if their gross income from all sources while a resident and gross income from Idaho sources while a nonresident is more than $2,500. Nonresidents must file an Idaho income tax return if their gross income from Idaho sources is more than $2,500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.