Loading

Get Ca Ftb 3885 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3885 online

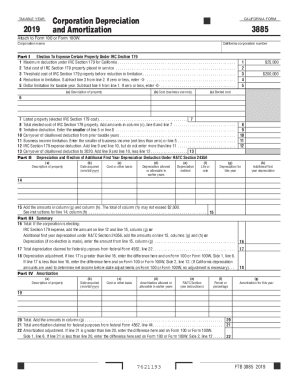

The California FTB 3885 form is essential for corporations to report depreciation and amortization for tax purposes. This guide provides step-by-step instructions for completing the form online, ensuring accuracy and compliance.

Follow the steps to fill out the CA FTB 3885 effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering the taxable year at the top of the form, ensuring you accurately reflect the relevant tax period.

- Complete the section labeled 'Corporation Name' and enter the California corporation number to identify your entity.

- In Part I, provide the maximum deduction under IRC Section 179, the total cost of the property placed in service, and calculate the reduction in limitation as instructed.

- List all properties in the given format with descriptions, costs, and elected costs to ensure proper calculation of deductions.

- Proceed to Part II, where you will document details regarding depreciation, including descriptions, acquisition dates, methods, and rates of depreciation.

- Continue to Part III to summarize total deductions, ensuring you follow the instructions to calculate figures accurately based on previous sections.

- In Part IV, fill in amortization details for the properties as required, ensuring all data corresponds with prior filings.

- Review all entered information for accuracy before proceeding to save changes, download, print, or share the completed form.

Complete your CA FTB 3885 and other necessary documents online to ensure timely filings.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

California provides special credits and accelerated write-offs that affect the California basis for qualifying assets. California does not conform to all the changes to federal law enacted in 1993. Therefore, the California basis or recovery periods may be different for some assets. On or after September 11, 2001.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.