Loading

Get Ma 355-7004 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA 355-7004 online

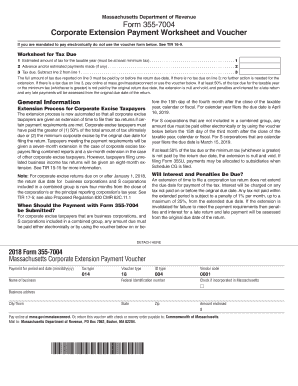

Navigating the MA 355-7004 form can seem daunting, but with clear guidance, you can confidently complete it online. This guide is designed to help you understand each part of the form, ensuring a smooth filing process.

Follow the steps to fill out the MA 355-7004 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the estimated amount of tax for the taxable year in the first field. Ensure that this amount meets the minimum tax requirements.

- In the second field, input any advance and/or estimated payments made. This will help in calculating the total tax due.

- Subtract the amount on line 2 from line 1 in the third field to determine the tax due. This will be important for your payment obligations.

- If tax is due based on line 3, make sure to pay the full amount by the return due date. If there is no tax due, you do not need to take further action for the extension.

- Complete the voucher section, ensuring to fill in the name of the business, tax type, and federal identification number.

- Verify that you have included any necessary state information, vendor code, and if your business is incorporated in Massachusetts.

- Finally, review all entered information carefully, then save your changes, download the form for your records, and print it if needed.

Complete your documents online to ensure accuracy and efficiency.

When you don't file a tax return by the due date, you may face interest charges on the amount you owe, a late payment penalty and a late filing penalty. If you don't owe any additional state tax beyond the amounts you paid through withholding and estimated taxes, you generally won't face penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.