Loading

Get La R-1086 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA R-1086 online

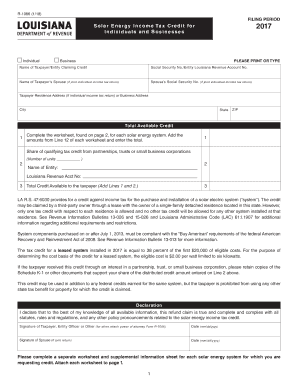

This guide aims to provide users with a clear and comprehensive overview of how to effectively complete the LA R-1086 form online. Designed for individuals and businesses claiming the solar energy income tax credit, this step-by-step resource is tailored to assist users of all backgrounds.

Follow the steps to complete the LA R-1086 form with ease.

- Click the ‘Get Form’ button to access the form and open it in your browser.

- Begin by entering the name of the taxpayer or entity claiming the credit, followed by the appropriate Social Security number or Louisiana Revenue Account number.

- If filing a joint individual income tax return, provide the name and Social Security number of the taxpayer’s spouse.

- Fill in the taxpayer residence address or business address, including the city, state, and ZIP code.

- Calculate the total available credit by completing the worksheet on the second page for each solar energy system. Add amounts from Line 12 of each worksheet to get the total.

- If applicable, indicate the share of qualifying tax credit from partnerships, trusts, or small business corporations, and provide the name of the entity along with its Louisiana Revenue Account number.

- Sign and date the declaration section confirming the accuracy of the information provided. If submitting a joint return, the spouse must also sign and date this section.

- Complete a separate worksheet and supplemental information sheet for each solar energy system for which you are requesting credit. Be sure to attach each worksheet to the primary form.

- Review all entered information for accuracy before proceeding to save changes, download, print, or share the completed form.

Start filling out your LA R-1086 online today to take advantage of the solar energy income tax credit.

Just visit www.revenue.louisiana.gov/refund and enter your social security number, tax year, your filing status, and the refund amount shown on your tax return. If you filed your taxes online, you can generally expect your refund within 60 days of the filing date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.