Loading

Get Irs 944 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 944 online

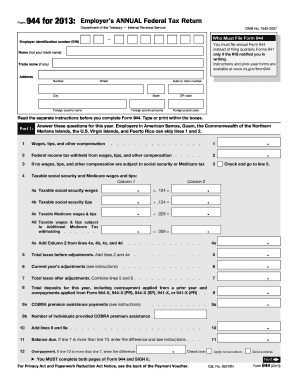

The IRS Form 944 is used by eligible employers to report their annual federal tax liabilities. This guide provides a detailed process to complete the form accurately and effectively online.

Follow the steps to fill out the IRS 944 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN) in the designated field.

- Provide your legal name and any trade name if applicable, along with your complete address, including city, state, and ZIP code.

- In Part 1, answer questions about wages, tips, compensation, and federal income tax withheld for the tax year.

- Complete lines for taxable social security and Medicare wages and tips, ensuring to follow the provided calculations for each field.

- Calculate total taxes before adjustments by adding lines from the previous entries, and enter this amount on line 5.

- If applicable, complete current year’s adjustments and enter results on line 6, then combine this with total taxes before adjustments on line 7.

- Report total deposits for the year on line 8, including any prior year’s overpayments if applicable.

- Initiate balance due or overpayment entries on lines 11 and 12, selecting your preferred action for overpayments.

- Fill out Part 2 if applicable, indicating your deposit schedule and tax liability.

- If your business has closed, complete Part 3 as necessary and provide the final date you paid wages.

- In Part 4, designate a third-party contact if desired, providing their name and phone number.

- Sign the form in Part 5, completing both pages, and ensure the declaration meets the perjury requirement.

- Once the form is completely filled out, review it for accuracy and save changes, as needed.

- You can then choose to download, print, or share the form as required.

Start completing your IRS 944 form online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To change your filing from Form 941 to IRS 944, you need to notify the IRS. Typically, this involves submitting a written request that demonstrates your eligibility. Ensure you do this before the filing deadline to transition smoothly and start using Form 944 for your employment taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.