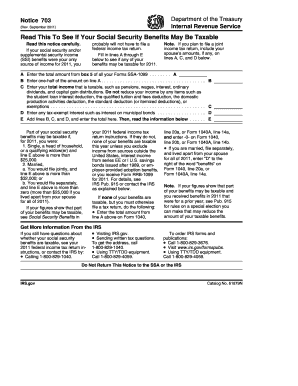

Get Irs Notice 703 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS Notice 703 online

How to fill out and sign IRS Notice 703 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When individuals aren’t linked with document administration and legal processes, completing IRS forms can be rather tiring. We recognize the significance of accurately finalizing documents. Our platform provides the answer to simplify the process of handling IRS documents as effortlessly as possible. Adhere to these suggestions to swiftly and correctly fill out IRS Notice 703.

The method to fulfill the IRS Notice 703 online:

Using our service can certainly facilitate professional completion of IRS Notice 703. Make everything for your convenience and simple work.

- Select the button Get Form to access it and begin editing.

- Complete all necessary fields in your document using our expert PDF editor. Activate the Wizard Tool to streamline the process significantly.

- Ensure the accuracy of the information provided.

- Incorporate the date of submitting IRS Notice 703. Utilize the Sign Tool to create a distinct signature for document validation.

- Finish editing by clicking on Done.

- Send this document directly to the IRS in the most convenient manner for you: via email, with digital fax, or postal service.

- You can print it on paper if a physical copy is needed and download or store it in your preferred cloud storage.

How to modify Get IRS Notice 703 2011: personalize forms online

Select a dependable document editing service you can rely on. Alter, complete, and authenticate Get IRS Notice 703 2011 safely online.

Frequently, altering documents, such as Get IRS Notice 703 2011, can be troublesome, particularly if you obtained them in a digital format but lack access to specialized software. Naturally, you can employ some alternatives to manage it, but you might end up with a form that won't meet the submission standards. Using a printer and scanner is not a viable choice either since it consumes time and resources.

We provide a more straightforward and efficient method for filling out files. An extensive collection of document templates that are simple to customize and authenticate, then turn into fillable forms for certain users. Our platform goes far beyond a mere set of templates. One of the remarkable features of using our service is that you can modify Get IRS Notice 703 2011 directly on our site.

Being an online-based solution, it spares you from needing to install any software on your computer. Furthermore, not all company policies permit you to install it on your corporate device. Here’s how you can effortlessly and securely finish your paperwork with our platform.

Ditch paper and other unproductive methods for finalizing your Get IRS Notice 703 2011 or other documents. Opt for our tool instead that boasts one of the most extensive collections of ready-to-edit templates and a powerful document editing feature. It's simple and secure and can save you precious time! Don’t just take our word for it, experience it yourself!

- Click the Get Form > you’ll be instantly directed to our editor.

- Once opened, you can begin the editing process.

- Select checkmark or circle, line, arrow, cross, and other choices to annotate your form.

- Choose the date option to add a specific date to your document.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to add fillable {fields.

- Select Sign from the top toolbar to create and add your legally-binding signature.

- Click DONE to save, print, share or download the final {file.

Related links form

To prove a hardship to the IRS, you typically need to provide documentation of your financial situation, including income statements, expenses, and any other relevant paperwork. You can also request a meeting with an IRS representative to discuss your case. If you’re unsure about the process, uslegalforms can help you gather the necessary documentation effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.