Get Irs Publication 1024 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Publication 1024 online

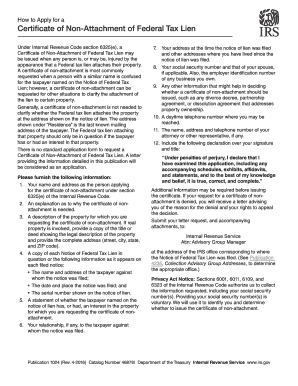

This guide provides users with a clear and straightforward approach to completing the IRS Publication 1024 online. By following these detailed steps, users can ensure that their applications for a Certificate of Non-Attachment of Federal Tax Lien are filled out accurately and efficiently.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name and address as the applicant for the certificate of non-attachment under section 6325(e) of the Internal Revenue Code.

- Explain why the certificate of non-attachment is needed.

- Describe the property for which you are requesting the certificate of non-attachment. If it involves real property, include a copy of the title or deed showing the legal description and the complete address.

- Attach a copy of each Notice of Federal Tax Lien in question or provide the following details from each notice: the taxpayer's name and address, the date and place filed, and the serial number on the notice.

- State whether the taxpayer named on the notice has or had an interest in the property for which you are requesting the certificate.

- Indicate your relationship, if any, to the taxpayer against whom the notice was filed.

- List your address when the notice of lien was filed, as well as other addresses you have lived at since then.

- Provide your social security number and that of your partner, if applicable, as well as the employer identification number of any business you own.

- Include any additional information that may assist in deciding whether to issue the certificate, such as any divorce decree, partnership agreement, or dissolution agreement regarding property ownership.

- Provide a daytime telephone number where you can be reached.

- If applicable, include the name, address, and telephone number of your attorney or representative.

- End your request with the declaration: 'Under penalties of perjury, I declare that I have examined this application and, to the best of my knowledge, it is true, correct, and complete.'

- Submit your letter request, along with all accompanying attachments, to the IRS office corresponding to where the Notice of Federal Tax Lien was filed.

Complete your application online for an efficient process.

Related links form

Digital assets are reported by disclosing ownership, sales transactions, and any income generated from them on your tax return. This includes cryptocurrencies and NFTs, which must be accurately documented to comply with IRS regulations. IRS Publication 1024 provides clear guidelines on how to categorize and report these assets properly. Platforms like US Legal Forms can offer support with forms and instructions to ensure you stay compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.