Get Irs Publication 15 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS Publication 15 online

How to fill out and sign IRS Publication 15 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When people aren’t linked to document management and legal procedures, completing IRS forms will be exceptionally challenging. We comprehend the importance of accurately finalizing paperwork.

Our platform offers the solution to simplify the process of submitting IRS forms as uncomplicated as possible. Adhere to these guidelines to submit IRS Publication 15 correctly and promptly.

Utilizing our online tool will enable professional completion of IRS Publication 15. We will ensure a comfortable and straightforward experience for your work.

- Click on the button Get Form to access it and begin editing.

- Complete all necessary fields in the chosen document with our expert PDF editor. Enable the Wizard Tool to facilitate the completion further.

- Verify the accuracy of the entered information.

- Add the date of completing IRS Publication 15. Use the Sign Tool to create your personal signature for document validation.

- Conclude editing by clicking on Done.

- Send this document to the IRS in the most convenient manner for you: via email, digital fax, or postal mail.

- You can print it on paper if a copy is needed and download or save it to your preferred cloud storage.

How to modify Obtain IRS Publication 15 2015: personalize forms online

Utilize our sophisticated editor to transform a basic online template into a finalized document. Continue reading to discover how to alter Obtain IRS Publication 15 2015 online effortlessly.

Once you locate a suitable Obtain IRS Publication 15 2015, all you need to do is modify the template to fit your requirements or legal obligations. In addition to filling out the form with precise information, you may need to eliminate certain clauses in the document that are unnecessary for your situation. Alternatively, you might wish to incorporate some additional stipulations in the original form. Our advanced document editing tools are the optimal means to amend and adjust the form.

The editor allows you to revise the content of any form, even if the file is in PDF format. You can add and remove text, insert fillable fields, and implement extra modifications while preserving the original formatting of the document. You can also reorganize the structure of the document by altering the page sequence.

There is no need to print the Obtain IRS Publication 15 2015 to sign it. The editor is equipped with electronic signature capabilities. Most of the forms already feature signature fields. Therefore, you merely need to include your signature and request one from the other signing party via email.

Follow this step-by-step guide to prepare your Obtain IRS Publication 15 2015:

Once all parties have signed the document, you will receive a signed copy that you can download, print, and share with others.

Our services allow you to save a significant amount of time and minimize the likelihood of errors in your documents. Improve your document workflows with efficient editing capabilities and a robust eSignature solution.

- Open the selected form.

- Utilize the toolbar to customize the form to your liking.

- Fill out the form with precise information.

- Click on the signature field and append your electronic signature.

- Send the document for signing to additional signers if necessary.

Related links form

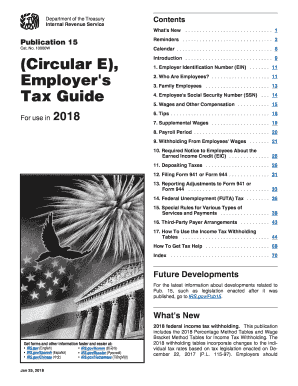

IRS publications serve to educate taxpayers and employers about tax laws and requirements to ensure compliance. These documents provide valuable information, including procedures, rates, and guidelines essential for proper filing and tax management. By staying informed through IRS publications, businesses and individuals can avoid unnecessary penalties and ensure accurate tax reporting. Leveraging platforms like US Legal Forms can further enhance your understanding of these important documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.