Get Irs Publication 915 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Publication 915 online

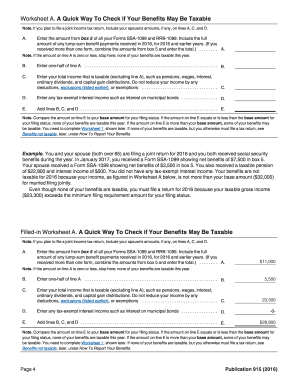

This guide offers step-by-step instructions on how to accurately complete the IRS Publication 915 form online, which is essential for understanding taxation on social security and equivalent railroad retirement benefits. By following these instructions, users can confidently navigate this important tax document.

Follow the steps to complete IRS Publication 915 effectively.

- Click the ‘Get Form’ button to retrieve the form and open it in the editor.

- Begin by entering your personal information, including your name and social security number, as required in the designated fields.

- Review the information regarding your benefits which may consist of form SSA-1099 or RRB-1099 and input the necessary data into the corresponding fields.

- Calculate any taxable amount based on your modified adjusted gross income and follow the guidelines on whether your benefits are taxable.

- Utilize worksheets A, 1, and any other resources provided within the document to determine the correct amounts for reporting on your tax return.

- Once all relevant fields are completed and checked for accuracy, proceed to save changes. You can also download, print, or share the completed form as needed.

Complete your tax documents online confidently and ensure compliance by utilizing the IRS Publication 915 form.

Get form

Related links form

IRS Form 8995 is used by eligible taxpayers to claim the qualified business income deduction, allowing them to reduce their taxable income. This form simplifies the process for eligible businesses, enhancing efficiency in tax reporting. By understanding your eligibility and requirements, you can leverage insights from IRS Publication 915 to maximize your benefits on Form 8995.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.