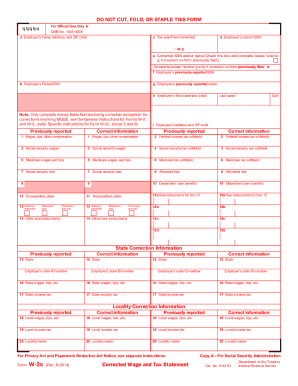

Get Irs W-2c 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-2C online

How to fill out and sign IRS W-2C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Reporting your income and declaring all the crucial taxation documents, including IRS W-2C, is a US citizen?s sole duty. US Legal Forms tends to make your taxes preparation a lot more transparent and accurate. You can find any lawful blanks you need and fill out them digitally.

How to prepare IRS W-2C on the web:

-

Get IRS W-2C in your web browser from any device.

-

Access the fillable PDF document with a click.

-

Start accomplishing the web-template field by field, following the prompts of the innovative PDF editor?s user interface.

-

Correctly type textual information and numbers.

-

Select the Date field to put the actual day automatically or alter it by hand.

-

Use Signature Wizard to design your custom e-signature and sign in seconds.

-

Refer to the Internal Revenue Service guidelines if you still have inquiries..

-

Click Done to save the edits..

-

Proceed to print the file out, save, or share it via E-mail, text message, Fax, USPS without leaving your browser.

Store your IRS W-2C safely. You should ensure that all your appropriate paperwork and records are in are in right place while bearing in mind the due dates and tax regulations set up with the Internal Revenue Service. Do it easy with US Legal Forms!

How to edit IRS W-2C: personalize forms online

Doing papers is more comfortable with smart online instruments. Get rid of paperwork with easily downloadable IRS W-2C templates you can edit online and print.

Preparing documents and paperwork should be more accessible, whether it is an everyday component of one’s job or occasional work. When a person must file a IRS W-2C, studying regulations and guides on how to complete a form correctly and what it should include might take a lot of time and effort. However, if you find the right IRS W-2C template, finishing a document will stop being a challenge with a smart editor at hand.

Discover a broader variety of features you can add to your document flow routine. No need to print, complete, and annotate forms manually. With a smart editing platform, all the essential document processing features are always at hand. If you want to make your work process with IRS W-2C forms more efficient, find the template in the catalog, select it, and discover a less complicated method to fill it in.

- If you need to add text in a random part of the form or insert a text field, use the Text and Text field tools and expand the text in the form as much as you require.

- Use the Highlight instrument to stress the important parts of the form. If you need to conceal or remove some text pieces, utilize the Blackout or Erase instruments.

- Customize the form by adding default graphic components to it. Use the Circle, Check, and Cross instruments to add these components to the forms, if required.

- If you need additional annotations, utilize the Sticky note resource and put as many notes on the forms page as required.

- If the form requires your initials or date, the editor has instruments for that too. Minimize the possibility of errors using the Initials and Date tools.

- It is also easy to add custom graphic components to the form. Use the Arrow, Line, and Draw instruments to customize the document.

The more instruments you are familiar with, the simpler it is to work with IRS W-2C. Try the solution that provides everything essential to find and edit forms in one tab of your browser and forget about manual paperwork.

To send documents to the IRS electronically, make use of IRS-approved e-filing software that allows for the secure upload of your documents. Ensure that all data is complete and accurate before submitting. The IRS provides specific guidelines regarding what documents can be submitted electronically. Using tools offered by uslegalforms can facilitate this process for ease of compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.