Loading

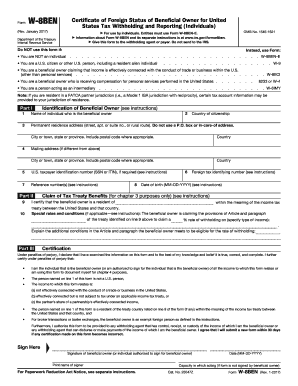

Get Irs W-8ben 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-8BEN online

Filling out the IRS W-8BEN form online can seem daunting, but with clear guidance, it becomes a manageable task. This guide will walk you through each section of the form, ensuring you understand the necessary steps and what information is required.

Follow the steps to correctly complete the IRS W-8BEN form online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- In Part I, provide the name of the individual who is the beneficial owner in the first field.

- Next, enter the permanent residence address, ensuring it does not include a P.O. box or in-care-of address. This includes street address, apartment or suite number, and rural route details.

- Indicate the country of citizenship in the following field.

- Complete the city or town, state or province, and include a postal code if applicable.

- In the next field, provide the mailing address if it is different from the permanent address. Include city or town, state or province, and the postal code.

- If required, enter the U.S. taxpayer identification number (SSN or ITIN) in the next section.

- Provide your foreign tax identifying number in the subsequent field.

- Fill in your date of birth in the MM-DD-YYYY format.

- For claim of tax treaty benefits, check the appropriate box and certify that you are a resident of the country listed.

- If applicable, specify the provisions of the treaty to claim a reduced withholding rate, including the type of income.

- In Part III, review the certification section, and ensure you understand the declarations made under penalties of perjury.

- Sign and date the form, indicating the capacity in which you are acting if it is not the beneficial owner.

- Finally, save your changes, and download, print, or share the form as necessary.

Start completing your IRS W-8BEN form online today to ensure accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The IRS W-8BEN form serves to establish that a foreign person or entity is a non-U.S. taxpayer. It enables the application of a reduced withholding tax rate on income received from U.S. sources. Additionally, it helps to claim benefits under an applicable tax treaty, making it essential for international transactions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.