Get Az Dor 5000 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ DoR 5000 online

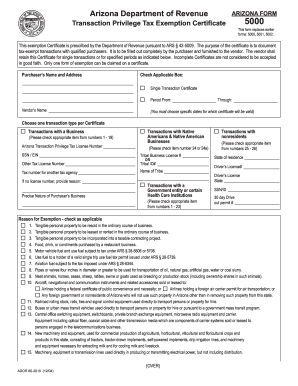

The Arizona Department of Revenue Form 5000 is essential for documenting tax-exempt transactions with qualified purchasers. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the AZ DoR 5000 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the purchaser’s name and address in the designated fields. Ensure that the information is accurate and complete.

- Check the applicable box for Single Transaction Certificate or Period. Specify the date range if applicable.

- Provide the vendor’s name in the specified area.

- Select the appropriate transaction type from the list provided. Choose one transaction type for the certificate.

- Fill in the Arizona Transaction Privilege Tax License Number or the appropriate identifiers such as SSN, EIN, or Tribal ID if relevant.

- In the section for the precise nature of the purchaser's business, provide a clear description of the business activities.

- Indicate the state of residence and the driver's license information as required.

- Select the reasons for exemption that apply to your transaction by checking the corresponding items from the provided list.

- In the certification section, print your full name, sign, and date the form to confirm accuracy and completeness before submission.

- Once completed, users can save changes, download, print, or share the form as needed to ensure proper documentation.

Complete the AZ DoR 5000 online today to ensure your tax-exempt transactions are documented correctly.

Get form

Related links form

The Arizona transaction privilege tax is essentially a tax on the income earned by businesses for various activities such as selling goods or providing services. This tax is calculated based on gross income, distinguishing it from typical sales taxes that are charged on the final sale to consumers. Business owners need to file the AZ DoR 5000 to report TPT accurately. Resources from USLegalForms simplify being compliant with this state tax requirement.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.