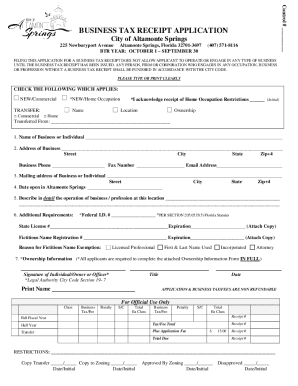

Get Fl Business Tax Receipt Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL Business Tax Receipt Application online

How to fill out and sign FL Business Tax Receipt Application online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Verifying your earnings and presenting all the essential tax documents, comprising FL Business Tax Receipt Application, is solely the duty of a US citizen.

US Legal Forms streamlines your tax management, making it more accessible and precise.

Safeguard your FL Business Tax Receipt Application. You should confirm that all your accurate documents and records are organized while being mindful of the deadlines and tax regulations established by the IRS. Simplify the process with US Legal Forms!

- Obtain the FL Business Tax Receipt Application on your device through your browser.

- Access the editable PDF form by clicking.

- Begin filling out the template field by field, guided by the prompts of the advanced PDF editor's interface.

- Accurately input text and numerical values.

- Choose the Date field to automatically insert the current date or modify it manually.

- Utilize Signature Wizard to create your unique e-signature and sign it within moments.

- Review IRS regulations if you have any further questions.

- Select Done to save the amendments.

- Proceed to print the document, download, or share it via Email, text message, Fax, or USPS without leaving your browser.

How to modify Get FL Business Tax Receipt Application: personalize forms online

Put the right document modification tools at your disposal. Complete Get FL Business Tax Receipt Application with our trustworthy service that includes editing and eSignature features.

If you want to execute and validate Get FL Business Tax Receipt Application online effortlessly, then our online cloud-based solution is the way to proceed. We provide a comprehensive template-based library of ready-to-use forms you can adjust and fill out digitally.

Additionally, you don't need to print the document or utilize third-party options to make it fillable. All essential tools will be accessible for your use once you open the file in the editor.

Edit and annotate the template

The top toolbar includes the tools that assist you in highlighting and obscuring text, without images and graphical elements (lines, arrows, and checkmarks, etc.), adding your signature to, initializing, dating the document, and more.

Arrange your documents Use the toolbar on the left if you want to reorder the document or remove pages.

- Inspect our online editing tools and their primary functions.

- The editor has a user-friendly interface, so it won't take much time to learn how to operate it.

- We’ll review three main components that enable you to:

To obtain a Florida RT account number, you need to complete an application through the Florida Department of Revenue's portal. Completing the FL Business Tax Receipt Application will usually involve providing detailed information about your business. Having this number will simplify your tax payment processes and ensure compliance with state requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.