Loading

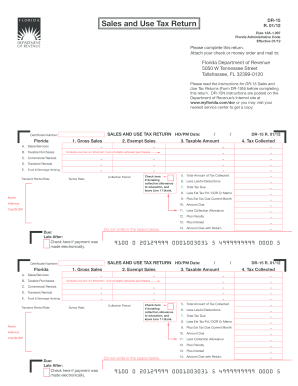

Get Fl Dor Dr-15 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FL DoR DR-15 online

Filling out the FL DoR DR-15 form online is an essential step for individuals and businesses reporting their sales and use tax. This guide aims to provide clear and supportive instructions to help you accurately complete the form, ensuring compliance with Florida tax regulations.

Follow the steps to complete your sales and use tax return online

- Click ‘Get Form’ button to obtain the FL DoR DR-15 and open it in the editor.

- Begin by entering your certificate number at the designated field.

- For Section A, report your gross sales and any exempt sales under the appropriate fields. Ensure to include all relevant figures.

- If applicable, complete Section B by listing your taxable purchases and any transient rentals you may have.

- Continue to Section C; here, you will detail commercial rentals if relevant to your business.

- In Section D, include food and beverage vending details as needed, ensuring accuracy.

- Calculate the total amount of tax collected in the provided field and subtract any lawful deductions indicated.

- Complete the lines regarding estimated tax payments and any penalties or interest that may apply to your account.

- Review your entries for accuracy, then save your changes, download the document, or print it for submission.

Complete your FL DoR DR-15 form online today for a seamless tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Florida DR-13 is another tax-related form used for sales and use tax purposes, often serving businesses that deal with specific tax exemptions. While the FL DoR DR-15 focuses more on current sales tax reporting, the DR-13 can address other tax responsibilities. Familiarity with both forms ensures comprehensive compliance with Florida tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.