Loading

Get Fl Dor Dr-5 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DoR DR-5 online

This guide provides clear and detailed instructions for completing the FL DoR DR-5 form online. Users of all experience levels will find the information helpful as they navigate the process of applying for a Consumer's Certificate of Exemption.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the FL DoR DR-5 form and open it in your preferred online editor.

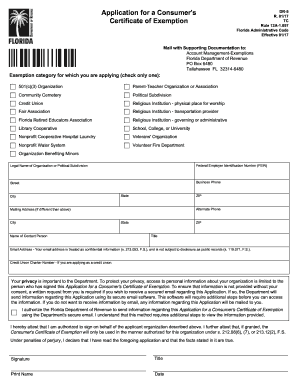

- Select the exemption category for which you are applying by checking only one of the provided options. Categories include 501(c)(3) organization, community cemetery, credit union, and more.

- Provide the legal name of your organization or political subdivision in the designated field.

- Enter the Federal Employer Identification Number (FEIN) in the specified box to verify your organization’s tax status.

- Complete the address section by entering the street address, city, state, and ZIP code for your organization along with the business phone and alternate phone numbers.

- If your mailing address differs from the physical address, fill in the mailing address section with the appropriate details.

- Name a contact person for your organization and provide their title, email address, and confirm the confidentiality of that email.

- If applying as a credit union, enter the Credit Union Charter Number in the applicable field.

- Review the statement regarding privacy and consent, and indicate whether you authorize the Florida Department of Revenue to send information via secure email.

- Sign the application to attest that you are authorized to submit it on behalf of your organization. Include your printed name, title, and the date of submission.

- Once all fields are completed, save your changes and download, print, or share the completed form as needed.

Complete your documents online today to ensure compliance and eligibility for tax exemptions.

Related links form

A Notice of Final Assessment from the Florida Department of Revenue (FL DoR) indicates an official determination of taxes owed by an individual or business. This notice typically follows an audit or review of previously filed returns. It outlines the specific tax liabilities and provides details on how to contest the assessment, if necessary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.