Loading

Get Fl Dor Dr-504cs 2000-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DoR DR-504CS online

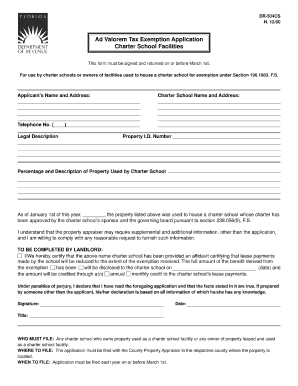

Filling out the FL DoR DR-504CS form online can streamline your paperwork and ensure accuracy. This guide will walk you through each section of the form, providing clear instructions tailored to users at all experience levels.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reviewing the introductory section of the form. This provides important background information on the purpose of the form and any necessary details you may need to complete it accurately.

- Proceed to the personal information section. Here, enter your full name, address, and contact information. Ensure that all details are correct to avoid delays in processing.

- Next, fill out the specific details regarding your situation as required by the form. This may include information about your objectives or the nature of your request. Take your time to ensure that all fields are completed accurately.

- Review the declaration section carefully. This part typically requires you to confirm the truthfulness of the information you have provided. Ensure you understand the statements before proceeding.

- Once you have filled out all sections of the form, it's crucial to recheck your entries for any errors or omissions. Accuracy is important for the processing of your form.

- After verifying your information, you can save your changes, download the completed form, print it for submission, or share it as needed.

Start completing your documents online today for a more efficient experience.

Related links form

Filing a DR 405 in Florida is mandatory if you wish to claim a homestead exemption based on your primary residence. It's crucial to submit this form accurately to benefit from the tax savings it offers. The FL DoR DR-504CS may also assist in differentiating your filing needs. Proper submission ensures that you stay compliant with local tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.