Get Fl Dor Dr-601g 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DoR DR-601G online

How to fill out and sign FL DoR DR-601G online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Reporting your earnings and submitting all necessary tax documents, including FL DoR DR-601G, is a sole obligation of a US citizen.

US Legal Forms aids in making your tax management much more accessible and accurate. You can find any legal templates you require and complete them digitally.

Store your FL DoR DR-601G safely. Make sure all your accurate documents and records are organized while considering the deadlines and tax laws set by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Access FL DoR DR-601G on your browser using any device.

- Click to open the fillable PDF document.

- Start filling out the template section by section, following the guidance of the advanced PDF editor's interface.

- Accurately enter text and numbers.

- Select the Date field to automatically set the current date or adjust it manually.

- Use Signature Wizard to create your unique electronic signature and certify in seconds.

- Refer to IRS guidelines if you have further questions.

- Click Done to save the changes.

- Continue to print the document, save it, or send it via Email, text messaging, Fax, or USPS without leaving your browser.

How to modify Get FL DoR DR-601G 2016: personalize forms on the web

Experience a hassle-free and paperless method of adjusting Get FL DoR DR-601G 2016. Utilize our reliable online service and conserve a significant amount of time.

Creating each document, including Get FL DoR DR-601G 2016, from the beginning requires excessive effort, so having a proven solution of pre-prepared document templates can work wonders for your productivity.

However, editing them may be challenging, particularly regarding files in PDF format. Thankfully, our extensive collection includes a built-in editor that allows you to effortlessly complete and modify Get FL DoR DR-601G 2016 without needing to exit our site, thus preventing you from spending time executing your paperwork. Here’s how to handle your document using our service:

Whether you need to finish customizable Get FL DoR DR-601G 2016 or any other document offered in our collection, you're on the right path with our online document editing tool. It's simple and secure and does not require specialized skills. Our web-based software is designed to manage nearly everything you can envision when it involves document editing and processing.

Forget about the outdated methods of managing your forms. Opt for a professional solution to streamline your tasks and reduce dependence on paper.

- Step 1: Locate the required form on our platform.

- Step 2: Click Get Form to access it in the editor.

- Step 3: Utilize advanced editing tools that enable you to insert, delete, comment on, and emphasize or obscure text.

- Step 4: Create and affix a legally-valid signature to your document using the signing option available in the upper toolbar.

- Step 5: If the form's format doesn't meet your needs, make use of the tools on the right to delete, add, and reorganize pages.

- Step 6: Include fillable fields so additional individuals can be invited to complete the form (if applicable).

- Step 7: Distribute or send the form, print it, or choose the format in which you'd like to save the document.

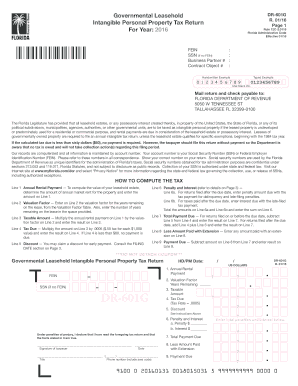

Intangible assets in Florida are taxed based on their total value above a certain exemption level. The tax rate is currently 2 mills for every dollar of value that exceeds the exemption. The FL DoR DR-601G form is essential for detailing these assets and ensuring correct tax payment. Understanding the tax structure can significantly affect your financial planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.