Loading

Get Fl Dor Dr-601g 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DoR DR-601G online

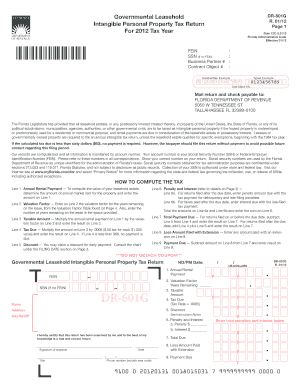

Filling out the FL DoR DR-601G form online is essential for lessees of governmental property in Florida. This guide provides a clear and supportive approach to navigating each section of the form, ensuring that users can complete it accurately and efficiently.

Follow the steps to complete the FL DoR DR-601G online.

- Press the ‘Get Form’ button to access the FL DoR DR-601G form and open it in the designated editor.

- Input your FEIN or SSN in the designated fields. If you do not have a FEIN, ensure to use your SSN for identification purposes.

- Fill in the Business Partner Number and Contract Object Number as applicable, which helps in identifying your lease.

- In Line 1, enter the Annual Rental Payment amount based on the market rent for the property you are leasing.

- Reference the Valuation Factor Table and fill out Line 2 by entering the valuation factor based on the number of years remaining on your lease.

- Calculate the Taxable Amount by multiplying the value from Line 1 by the value from Line 2, and enter the result on Line 3.

- On Line 4, compute the Tax Due by multiplying the amount on Line 3 by 0.0005 (this represents the tax rate).

- If eligible, list any Discount on Line 5 based on early payment provisions outlined in the instructions.

- For any Penalty and Interest applicable, enter the amounts on Lines 6a and 6b, accordingly.

- Calculate the Total Payment Due by entering the result from Line 7 into the designated field, applying previous calculations accordingly.

- If applicable, enter any amount paid with an extension on Line 8.

- Finalize by calculating the Payment Due on Line 9, which is the total amount owed after deducting any extensions.

- Review all entered information to confirm its accuracy. Once satisfied, proceed to save changes, download, or print the completed form as needed.

Complete your FL DoR DR-601G form online today for a smoother filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Tangible personal property generally does not go through probate in Florida, provided there are clear directives regarding ownership. Instead, it can be transferred according to the owner’s wishes upon death. For further clarity on this issue, the FL DoR DR-601G can serve as a helpful resource.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.