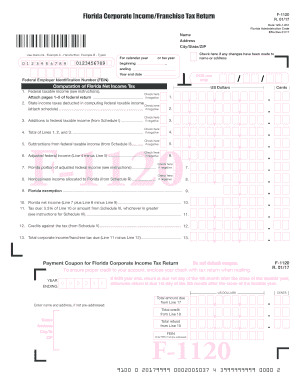

Get Fl Dor F-1120 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DoR F-1120 online

How to fill out and sign FL DoR F-1120 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Submitting your income and reporting all essential tax documents, including FL DoR F-1120, is a US citizen's primary responsibility.

US Legal Forms simplifies your tax management and enhances accuracy.

Securely retain your FL DoR F-1120. Ensure that all your essential documentation and information are correctly organized while adhering to the deadlines and tax regulations set by the Internal Revenue Service. Make it easy with US Legal Forms!

- Access FL DoR F-1120 on your browser from any device.

- Click to open the fillable PDF document.

- Begin filling out the online template field by field, following the prompts of the advanced PDF editor's interface.

- Precisely enter text and numerical data.

- Select the Date field to automatically insert the current date or change it manually.

- Utilize the Signature Wizard to create your personalized e-signature and sign in moments.

- Refer to IRS guidelines if you have further inquiries.

- Click Done to finalize the modifications.

- Proceed to print the document, save it, or send it via email, text, fax, or USPS without leaving your browser.

How to alter Get FL DoR F-1120 2017: personalize forms digitally

Explore a dedicated service to handle all your documentation effortlessly. Locate, alter, and finalize your Get FL DoR F-1120 2017 within a single platform utilizing intelligent tools.

The era of needing to print forms or manually write them is a thing of the past. Today, all that is required to obtain and complete any form, such as Get FL DoR F-1120 2017, is to open a single web browser tab. Here, you can locate the Get FL DoR F-1120 2017 form and personalize it in any way you desire, from typing directly into the document to sketching on a digital sticky note and attaching it to the file. Discover tools that will enhance your documentation process with minimal effort.

Simply click the Get form button to arrange your Get FL DoR F-1120 2017 paperwork effortlessly and begin altering it immediately. In the editing mode, you can conveniently fill in the template with your details for submission. Just click on the section you wish to edit and input the information right away. The editor's interface does not require any specific expertise to navigate it. Once finished with your modifications, verify the details' correctness once again and sign the document. Click on the signature area and follow the prompts to eSign the form in no time.

Utilize Additional tools to personalize your form:

Preparing Get FL DoR F-1120 2017 forms will never be perplexing again if you know where to find the appropriate template and prepare it simply. Do not hesitate to try it for yourself.

- Employ Cross, Check, or Circle tools to highlight the document's information.

- Insert text or fillable text fields using text formatting tools.

- Erase, Highlight, or Blackout text segments in the document with suitable tools.

- Add a date, initials, or even an image to the document if needed.

- Take advantage of the Sticky note tool to annotate the form.

- Use Arrow and Line, or Draw tool to incorporate visual elements into your document.

Related links form

IRS Form 1120 Schedule F is used to report the income and deductions of farming operations conducted by C corporations. If your business involves agriculture, this schedule specifies what expenses and revenue you must account for. When completing tax forms like FL DoR F-1120, it is important to integrate information correctly from all relevant schedules to ensure accurate reporting.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.