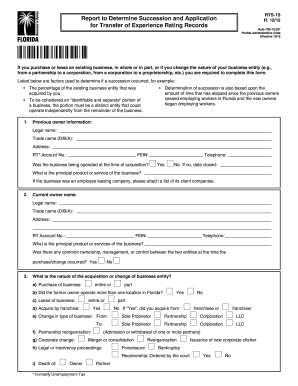

Get Fl Dor Rts-1s 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DoR RTS-1S online

How to fill out and sign FL DoR RTS-1S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Documenting your income and reporting all the necessary tax filings, including FL DoR RTS-1S, is a responsibility exclusive to US citizens. US Legal Forms simplifies your tax management, making it clearer and more accurate. You can locate any legal forms you need and fill them out electronically.

How to fill out FL DoR RTS-1S online:

Keep your FL DoR RTS-1S secure. You must ensure that all your correct documents and information are in the proper place while adhering to the time constraints and tax regulations established by the Internal Revenue Service. Simplify it with US Legal Forms!

- Obtain FL DoR RTS-1S through your web browser on your device.

- Access the fillable PDF file with a click.

- Start filling out the form field by field, following the guidance of the advanced PDF editor’s interface.

- Correctly enter text and numbers.

- Click the Date field to automatically set the current date or change it manually.

- Use the Signature Wizard to create your personalized electronic signature and sign within seconds.

- Refer to the Internal Revenue Service guidelines if you have further questions.

- Click on Done to save the edits.

- Proceed to print the document, save it, or send it via email, SMS, fax, or USPS without leaving your browser.

How to modify Get FL DoR RTS-1S 2015: personalize forms online

Experience a worry-free and paperless method of altering Get FL DoR RTS-1S 2015. Utilize our trustworthy online service and save a significant amount of time.

Creating each document, including Get FL DoR RTS-1S 2015, from the ground up demands a considerable amount of effort, so having a proven solution of pre-prepared form templates can work wonders for your productivity.

However, adjusting them can pose challenges, particularly with documents in PDF format. Fortunately, our vast collection features an integrated editor that enables you to effortlessly complete and modify Get FL DoR RTS-1S 2015 without having to leave our site, ensuring you do not waste hours handling your paperwork. Here’s what to do with your document using our service:

Whether you need to fill out editable Get FL DoR RTS-1S 2015 or any other form in our inventory, you’re on the right path with our online document editor. It’s straightforward and secure, and doesn’t require any specialized technical knowledge. Our web-based tool is crafted to handle nearly everything you can consider regarding file editing and processing.

Stop relying on traditional methods of managing your documents. Opt for a professional solution to help you streamline your tasks and reduce your dependence on paper.

- Step 1. Locate the necessary form on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our specialized editing tools that empower you to add, delete, annotate, and highlight or obscure text.

- Step 4. Generate and append a legally-recognized signature to your document by using the sign option from the top menu.

- Step 5. If the form's appearance isn't as you prefer, employ the options on the right to eliminate, add more, and organize pages.

- Step 6. Insert fillable fields so that others can be invited to complete the form (if necessary).

- Step 7. Distribute or send the document, print it, or select the format in which you want to download the file.

Related links form

A Florida Department of Revenue Notice of Final Assessment is an official statement informing you of the final determination regarding your tax obligations. This notice will detail the amounts owed, if any, and the reasons behind the assessment. Understanding the FL DoR RTS-1S can help you respond correctly to such notices.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.