Get Fl Dr-116100 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DR-116100 online

How to fill out and sign FL DR-116100 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

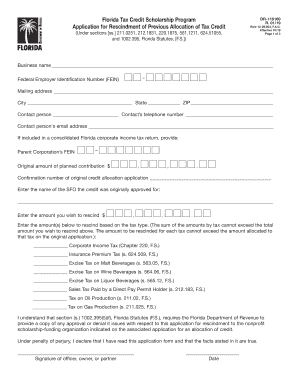

Reporting your income and filing all the essential tax documents, including FL DR-116100, is a duty of every US citizen.

US Legal Forms simplifies your tax preparation, making it more convenient and effective. You can obtain any legal forms you require and fill them out digitally.

- Acquire FL DR-116100 through your web browser from your device.

- Access the fillable PDF form with a click.

- Start filling out the online template section by section, adhering to the prompts of the advanced PDF editing software's interface.

- Carefully enter textual details and figures.

- Select the Date field to automatically insert the current date or modify it manually.

- Utilize the Signature Wizard to create your personalized e-signature and authenticate in minutes.

- Refer to IRS instructions if you have further questions..

- Hit Done to save your changes..

- Proceed to print the document, save it, or send it via Email, SMS, Fax, USPS without leaving your browser.

How to Modify Get FL DR-116100 2019: Personalize Forms Online

Experience a hassle-free and paperless method of altering Get FL DR-116100 2019. Utilize our dependable online service and conserve valuable time.

Creating each document, including Get FL DR-116100 2019, from the ground up consumes excessive time, so possessing a reliable assortment of premade form templates can significantly enhance your productivity.

However, changing them can be challenging, particularly with documents in PDF format. Luckily, our extensive library features a built-in editor that enables you to effortlessly complete and modify Get FL DR-116100 2019 without leaving our site, preventing you from wasting hours on your paperwork. Here's how to utilize our tools with your file:

Whether you need to fill out editable Get FL DR-116100 2019 or any other documents available in our collection, you’re on the right path with our online document editor. It's user-friendly and secure, requiring no special skills.

Our web-based tool is designed to manage nearly everything you can imagine regarding document editing and completion. Say goodbye to traditional methods of handling your documents. Choose a professional solution to assist you in streamlining your tasks and reducing dependence on paper.

- Step 1. Find the necessary form on our website.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize specialized editing tools that allow you to add, delete, comment, and highlight or obscure text.

- Step 4. Generate and incorporate a legally-binding signature into your document using the sign option from the top toolbar.

- Step 5. If the document structure doesn’t appear as desired, use the features on the right to eliminate, add more, and rearrange pages.

- Step 6. Include fillable fields so other parties can be invited to complete the document (if applicable).

- Step 7. Distribute or send the document, print it, or select the format for downloading.

Related links form

To fill out your W4 correctly, ensure that you attend to each section meticulously. Begin with your personal information, then accurately claim allowances based on your financial situation as outlined in the FL DR-116100. Double-check your entries for accuracy; any mistakes can affect your tax withholding and possible refund down the line.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.