Get Fl Dr-116100 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DR-116100 online

How to fill out and sign FL DR-116100 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

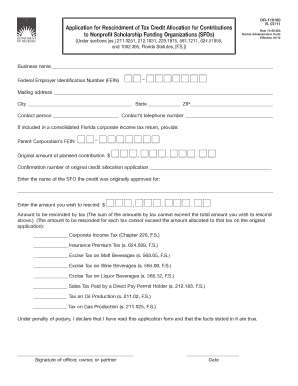

Reporting your earnings and providing all essential tax documents, such as FL DR-116100, is an obligation of a US citizen. US Legal Forms simplifies your tax management, making it more clear and precise. You can obtain any legal templates you require and complete them digitally.

Procedure to complete FL DR-116100 online:

Keep your FL DR-116100 secure. Make sure that all your correct documents and records are organized while considering the deadlines and tax regulations set by the IRS. Simplify the process with US Legal Forms!

- Access FL DR-116100 on your device using your web browser.

- Click to open the fillable PDF document.

- Start filling out the template section by section, following the instructions of the advanced PDF editor's interface.

- Carefully enter text and figures.

- Click the Date field to automatically set the current date or edit it manually.

- Use the Signature Wizard to create your personalized e-signature and sign in moments.

- Consult the IRS guidelines if you have further inquiries.

- Click Done to save the modifications.

- Proceed to print the document, save it, or share it via Email, text message, Fax, or USPS without leaving your browser.

How to modify Get FL DR-116100 2011: personalize forms online

Streamline your document creation workflow and tailor it to your specifications within moments. Complete and endorse Get FL DR-116100 2011 using a robust yet user-friendly online editor.

Handling paperwork is always challenging, particularly when you manage it occasionally. It requires you to adhere strictly to all regulations and accurately fill in all fields with complete and precise information. Nonetheless, it frequently happens that you need to alter the form or add additional fields to fill in. If you need to enhance Get FL DR-116100 2011 before submission, the most effective method to achieve this is by utilizing our robust yet easy-to-use online editing tools.

This comprehensive PDF editing solution enables you to swiftly and effortlessly complete legal documents from any device with an internet connection, make simple alterations to the form, and include more fillable fields. The service allows you to designate a specific area for each type of information, such as Name, Signature, Currency, and SSN, etc. You can set them as mandatory or conditional and designate who should complete each field by assigning them to a specific recipient.

Follow the steps outlined below to enhance your Get FL DR-116100 2011 online:

Our editor is a versatile multi-functional online tool that can assist you in swiftly and seamlessly refining Get FL DR-116100 2011 and other forms according to your needs. Reduce document creation and submission time while ensuring your forms are impeccable without any inconvenience.

- Open the desired document from the directory.

- Complete the fields with Text and place Check and Cross symbols in the checkboxes.

- Use the toolbar on the right side to adjust the form with new fillable sections.

- Select the fields according to the kind of data you want to be collected.

- Set these fields as mandatory, optional, or conditional and adjust their sequence.

- Assign each field to a specific party using the Add Signer tool.

- Review to ensure all necessary modifications have been made and click Done.

Related links form

When listing dependents on your W4, the dollar amount is based on the tax benefits you may claim. Each dependent you claim generally equals a specific monetary value that reduces your taxable income. Ensure you refer to the FL DR-116100 form for up-to-date information regarding the dollar amounts for dependents, helping you optimize your W4 effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.