Loading

Get Fl Dr-133 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-133 online

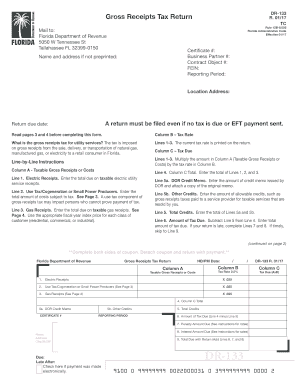

The FL DR-133 form is essential for reporting gross receipts tax for utility services in Florida. This guide will provide you with clear, step-by-step instructions to accurately complete the form online, ensuring compliance with tax regulations.

Follow the steps to effectively complete the FL DR-133 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering your certificate number, business partner number, contract object number, and FEIN at the top of the form. If your name and address are not preprinted, fill in the required information in the designated fields.

- Indicate the reporting period for which you are filing the return.

- In Column A, enter the taxable gross receipts or costs. For Line 1, input the total electric receipts. For Line 2, include the use tax/cogeneration or small power producers' costs. For Line 3, enter the total gas receipts.

- In Column B, check that the tax rate of 2.5% is correctly documented for each line.

- Calculate the tax due in Column C by multiplying the values in Column A by the corresponding tax rate in Column B.

- For Line 5, input any credits you may have. Line 5a is for entering DOR credit memos, and Line 5b is for other credits including previously paid gross receipts taxes.

- Complete Line 6 by subtracting Line 5 from Line 4 to determine the total amount of tax due.

- If your return is submitted late, appropriately complete Lines 7 and 8 for penalties and interest due.

- In Line 9, calculate and enter the total due with your return by adding the amounts from Lines 6, 7, and 8.

- Ensure you sign and date the return. The signature must be from an authorized representative of the business.

- Finally, review all entries for accuracy, then save your changes, download the form, or print it, as required for submitting your payment.

Complete your Florida gross receipts tax documents online today for a seamless filing experience.

Related links form

Florida DR-13 refers to the form used to claim various tax exemptions related to utility services. This form is critical for individuals and entities seeking to clarify their exempt status regarding utility taxes. Understanding the details provided in FL DR-133 can facilitate the correct completion of the DR-13 form, making tax compliance smoother.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.