Loading

Get Fl Dr-146 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-146 online

Completing the FL DR-146 online can be straightforward with the right guidance. This guide provides step-by-step instructions to assist users in filling out the Miami-Dade County Lake Belt Mitigation Fees Return accurately and efficiently.

Follow the steps to complete the FL DR-146 online.

- Press the ‘Get Form’ button to access the FL DR-146 and open it for editing.

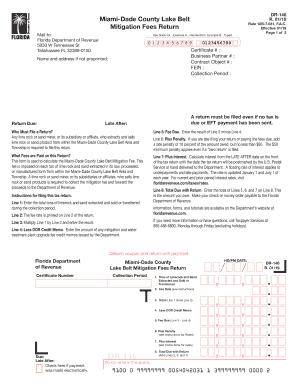

- Fill in your Certificate Number, Business Partner Number, Contract Object Number, Federal Employer Identification Number (FEIN), and the Collection Period. If this information is not preprinted, ensure it is completed accurately.

- Enter the total tons of lime rock and sand extracted and sold or transferred during the collection period on Line 1.

- Refer to Line 2 to find the fee rate for the mitigation fee which is printed on the form.

- On Line 3, multiply the amount entered in Line 1 by the fee rate from Line 2. Document the result.

- If applicable, record any DOR credit memo amounts on Line 4 that you have received.

- Calculate the fee due by subtracting the credit memo (Line 4) from the total calculated in Line 3 and write the result on Line 5.

- If your return is filed late, add a late penalty of 10 percent of the amount owed (minimum of $50) on Line 6.

- Determine any interest charged for late payment or underpayment based on the rates provided, and record that amount on Line 7.

- Add the amounts from Lines 5, 6, and 7 to determine the total amount due and enter that figure on Line 8.

- Review your completed form for accuracy. Sign and date your return in the designated areas.

- Finally, save your changes, and you can choose to download, print, or share the form as needed before submitting it to the Florida Department of Revenue.

Start filling out your FL DR-146 online today to ensure timely and accurate submission.

Related links form

Renewing your Florida Department of Revenue Consumer's Certificate of Exemption involves submitting a renewal application with any required documentation through their online portal or by mail. Ensure that you meet the renewal requirements to avoid any complications. Using uslegalforms can provide you with guidance and resources for managing the FL DR-146 renewal process effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.