Get Fl Dr-151 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-151 online

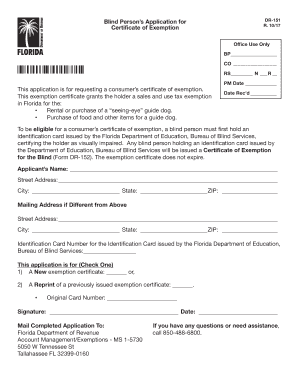

The FL DR-151 form is an important application for obtaining a consumer's certificate of exemption for individuals who are visually impaired. This certificate allows for sales and use tax exemptions in Florida for specific needs related to guide dogs. This guide will help you navigate the online process of filling out the form with clear instructions.

Follow the steps to complete the FL DR-151 application online

- Click ‘Get Form’ button to access the FL DR-151 application and open it in your preferred online form editor.

- Begin by filling in your full name in the 'Applicant's Name' field. Ensure this information matches the identification card issued by the Florida Department of Education, Bureau of Blind Services.

- Provide your street address in the designated field. This is your primary residence address.

- Fill in your city, state, and ZIP code in the corresponding fields to complete your address details.

- If your mailing address differs from your residential address, complete the 'Mailing Address if Different from Above' section with the required details.

- Enter your Identification Card Number as issued by the Florida Department of Education, Bureau of Blind Services in the specified field.

- Indicate the purpose of your application by checking either 'A New exemption certificate' or 'A Reprint of a previously issued exemption certificate' as applicable.

- If you are applying for a reprint, provide the Original Card Number for the certificate you wish to reprint.

- Sign the application with your name in the 'Signature' field. Date the application using the current date in the designated area.

- Once all sections are complete, save your changes, and you can choose to download, print, or share the completed application as needed.

Complete your FL DR-151 application online today for a smoother process in obtaining your exemption certificate.

Related links form

Florida does not impose a state personal income tax, making tax filing easier for residents. As a result, there is no specific personal income tax form required at the state level. However, federal tax obligations still apply, and it is wise to stay informed about federal requirements. If you need assistance with any filing or tax-related processes, resources like uslegalforms can provide helpful guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.