Loading

Get Fl Dr-15air 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15AIR online

This guide provides a clear and supportive framework for completing the FL DR-15AIR form, which is essential for reporting Florida’s sales and use tax on aircraft purchases. Whether you are a first-time user or familiar with tax forms, this comprehensive guide will help simplify the process for you.

Follow the steps to complete the FL DR-15AIR form efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

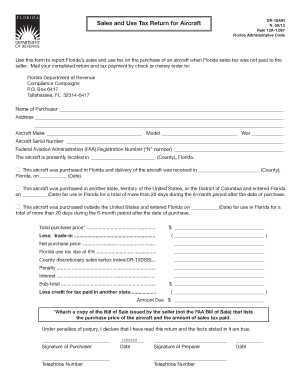

- Begin by filling in the name of the purchaser in the designated field. Ensure that the name is accurate and matches your legal identification.

- Provide your address, including city, state, and zip code, in the appropriate fields. Double-check for accuracy to avoid processing delays.

- Enter the aircraft make, model, and year in the corresponding boxes. This information is crucial for correctly assessing the applicable taxes.

- Fill in the aircraft serial number and the Federal Aviation Administration (FAA) registration number. These identifiers are necessary for the state's records.

- Indicate the county where the aircraft is currently located. This helps in determining the applicable local sales surtax.

- Specify the county where the aircraft was purchased and the exact date of delivery. Ensure this date aligns with your records.

- If applicable, provide the date when the aircraft was brought into Florida from another state, territory, or country for use.

- Report the total purchase price of the aircraft in the designated section. Be sure to include any trade-in allowances in this calculation.

- List any trade-in values in the space provided. This will help accurately compute the net purchase price.

- Calculate the Florida use tax due at 6% on your net purchase price. Include any applicable county discretionary sales surtax as well.

- Include any penalties or interest if applicable, and complete the subtotal calculation.

- If you paid taxes in another state, list the credit. This will reduce the amount due if you qualify.

- Clearly state the final amount due and ensure all figures are accurate before signature.

- Sign and date the form where indicated. If someone else prepared the form, they should also provide their signature and date.

- Review your completed form for any errors or omissions. Once satisfied, save your changes before proceeding to submit the form online.

- After saving, you may download, print, or share the form as necessary for your records or submission.

Complete your FL DR-15AIR form online today to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To amend a DR-15 form in Florida, you must fill out the updated FL DR-15AIR form, providing the necessary corrections to your original application. Make sure to indicate the specific changes and submit it to the appropriate tax authority. Keeping accurate records will also help streamline this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.