Loading

Get Fl Dr-15dss 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15DSS online

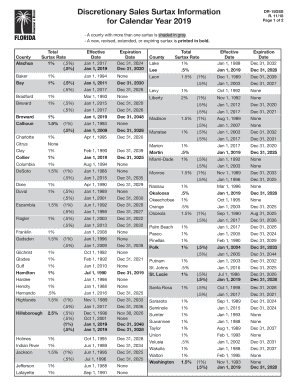

The FL DR-15DSS form is essential for reporting discretionary sales surtax rates in Florida counties. This guide will help users complete the form online, ensuring they provide accurate information in each section.

Follow the steps to successfully complete the FL DR-15DSS form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the county of interest from the provided list. Each county will have a total surtax rate, effective dates, and expiration dates listed. Make sure to take note of the pertinent details.

- Input the total surtax rate for your chosen county in the designated field. Ensure that you provide the correct percentage as per the table.

- Fill in the effective date for the surtax in the appropriate field. This date indicates when the surtax begins.

- Enter the expiration date if applicable. Some surtaxes do not have a set expiration date, while others do.

- Review all filled information for accuracy to ensure compliance with regulations.

- Once all sections are complete, users can save the changes, download, print, or share the form according to their requirements.

Complete your FL DR-15DSS form online for a streamlined filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing for summary administration in Florida without a lawyer can be straightforward if you understand the required steps. You will need to complete the necessary forms, which include the FL DR-15DSS, and file them with your local court. It’s essential to gather all relevant documents, including the death certificate and the will if applicable. Utilizing online resources, such as US Legal Forms, can simplify this process and provide the proper forms you need.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.