Loading

Get Fl Dr-15dss 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15DSS online

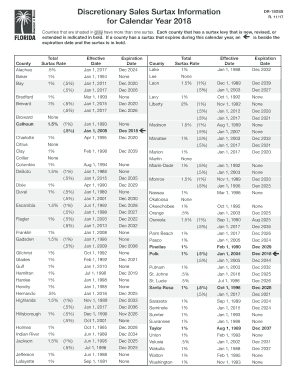

The FL DR-15DSS form is essential for understanding sales surtax information across various counties in Florida for the calendar year 2018. This guide provides a clear, step-by-step approach to successfully filling out this form online, ensuring that users can navigate the process with ease.

Follow the steps to complete the FL DR-15DSS form online effectively.

- Press the ‘Get Form’ button to access the FL DR-15DSS form and open it in your preferred online editor.

- Review the form’s header section, which details crucial information such as the total effective surtax rates for each county. Ensure you understand this information as it is vital for filling out the accompanying sections.

- In the county section of the form, identify the county you reside in and take note of its applicable surtax rate and expiration dates. Input this information accurately as it varies significantly between counties.

- Examine any changes or updates in surtax rates as specified for the year 2018. Make sure to include any relevant adjustments that may impact your calculations.

- Once all necessary fields are filled out and double-checked for accuracy, finalize the form. You will have the option to save changes, download, print, or share the form as needed.

Take the next step and complete your documents online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Florida sales tax penalties are calculated based on the amount of tax owed and the duration of non-compliance. Typically, the longer you delay payment, the higher the penalty will be. To navigate this process smoothly, utilizing the FL DR-15DSS form can provide the necessary guidance to ensure you remain compliant and avoid additional fees.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.