Loading

Get Fl Dr-15mo 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15MO online

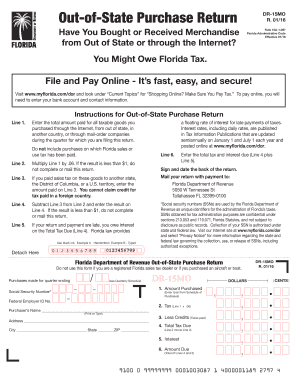

The FL DR-15MO form is utilized for reporting out-of-state purchases that may be subject to Florida's use tax. Completing this form online is straightforward, and each section is designed to guide you through the necessary information required for proper tax reporting.

Follow the steps to accurately complete the FL DR-15MO form online.

- Click the ‘Get Form’ button to obtain the FL DR-15MO form and open it in your browser for editing.

- In Line 1, enter the total amount you paid for all taxable goods purchased from out of state, internationally, or through internet sales during the relevant quarter.

- Proceed to Line 2 and calculate the tax by multiplying the amount in Line 1 by .06.

- If you paid sales tax on these purchases to another state, enter that amount in Line 3. Note that tax paid to foreign countries cannot be credited.

- Subtract the amount in Line 3 from Line 2 to find your total tax due, and enter this result in Line 4.

- If applicable, determine interest owed on unpaid taxes by referring to Line 5 and combine it with your total tax due.

- Lastly, sign and date the back of the return. Then mail your completed form along with payment to the Florida Department of Revenue at the provided address.

Complete your FL DR-15MO form online today to ensure compliance with Florida tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The threshold for sales tax in Florida primarily relates to whether a seller is required to collect tax based on their annual sales volume. If your business reaches a certain level of taxable sales, you must register for and collect sales tax. Make sure to keep track of your sales with tools designed to help you navigate the FL DR-15MO.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.