Loading

Get Fl Dr-15tdt 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15TDT online

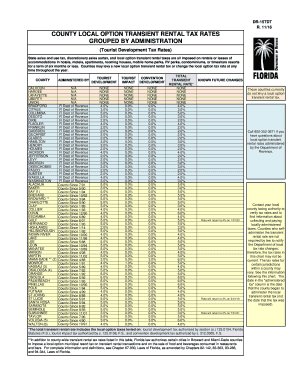

The FL DR-15TDT form is essential for reporting local option transient rental tax rates in Florida. This guide provides a step-by-step approach to filling out the form online, ensuring a smooth experience for users, regardless of their prior knowledge.

Follow the steps to successfully complete the FL DR-15TDT online.

- Click the ‘Get Form’ button to access the FL DR-15TDT form and open it in your preferred online editor.

- Identify the county for which you are reporting transient rental tax rates. This information is crucial as it determines the applicable tax rates for your area.

- Review the columns under the headers: Administered by, Tourist Development, Tourist Impact, and Convention Development. Ensure that you understand how these taxing parameters apply to your county.

- Locate the transient rental tax rates that apply to your county, listed by the percentage values. Make note of any unique rates based on specific zip codes, if applicable.

- Complete any additional sections that require your information, ensuring accuracy and completeness in your entries.

- After filling out the form, review all entries for any errors or omissions. It is vital to ensure that the information is correct for compliance and tax purposes.

- Once you have verified your information, save your changes. You will have options to download, print, or share the completed form as needed.

Start filling out the FL DR-15TDT online to ensure compliance with your county's tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To calculate Florida sales and use tax, determine the applicable tax rate based on your location and the sale amount. Multiply the sale amount by the tax rate to find the tax owed. For accurate calculations and the tools that can assist you, consulting FL DR-15TDT can be beneficial.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.