Get Fl Dr-17b 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-17B online

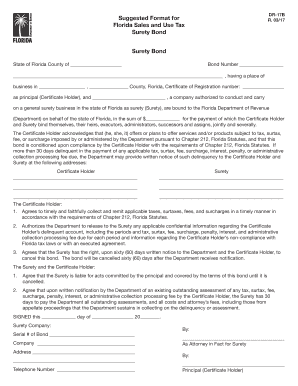

The FL DR-17B form is essential for individuals and businesses in Florida who need to establish a surety bond related to sales and use tax obligations. This guide provides comprehensive, step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to fill out the FL DR-17B online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the 'Bond Number' section with the specific number assigned to the bond.

- Enter the principal's information, including the name and business address under the ‘Having a place of business’ section. Make sure to provide the county and registration number as required.

- Provide the surety company's name. Ensure that the company is authorized to conduct surety business in Florida.

- Specify the amount of the bond in the 'sum' field, representing the financial obligation secured by this bond.

- Review the acknowledgment section where the Certificate Holder agrees to comply with applicable tax requirements.

- Complete the addresses for the Certificate Holder and the Surety to ensure correct communication regarding compliance and delinquency notifications.

- Review and agree to the outlined responsibilities of the Certificate Holder and Surety, ensuring all conditions are understood.

- Sign the document in the designated areas for both the Surety Company representative and the Certificate Holder, including the date.

- Save your changes, and download or print the finalized FL DR-17B form for your records. Ensure to share it as necessary.

Complete your FL DR-17B online today to ensure compliance with Florida's sales and use tax regulations.

Related links form

If you do not file taxes in Florida, you may face penalties, interest on unpaid amounts, and other consequences. The Florida Department of Revenue can assess fines and take actions to collect owed taxes. It's important to stay informed about your obligations and consider filing the FL DR-17B to remain compliant and avoid further complications. Seeking advice from tax professionals can provide the best path forward.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.