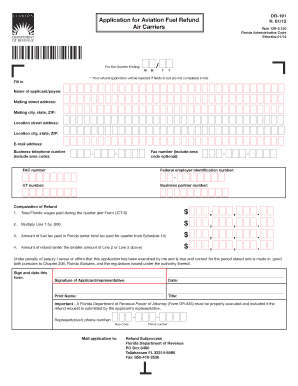

Get Fl Dr-191 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DR-191 online

How to fill out and sign FL DR-191 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Verifying your earnings and submitting all the necessary tax documentation, including FL DR-191, is the exclusive responsibility of a US citizen.

US Legal Forms makes your tax management much clearer and more precise.

Keep your FL DR-191 safe. Ensure that all your necessary documents and information are in the right place while remembering the deadlines and tax regulations set by the Internal Revenue Service. Make it simple with US Legal Forms!

- Obtain FL DR-191 in your web browser from any device.

- Access the editable PDF document with just a click.

- Begin filling out the web-template field by field, following the instructions of the advanced PDF editor's interface.

- Carefully enter text and numbers.

- Click the Date box to automatically insert today’s date or modify it manually.

- Use Signature Wizard to create your personalized e-signature and authenticate within moments.

- Refer to IRS guidelines if you have any remaining questions.

- Click Done to save your alterations.

- Proceed to print the document, download it, or share it via email, text message, fax, or USPS without leaving your web browser.

How to Alter Get FL DR-191 2012: Personalize Forms Online

Streamline your document preparation procedure and tailor it to your specifications in just a few clicks. Finalize and endorse Get FL DR-191 2012 with a robust yet user-friendly online editor.

Document preparation is frequently challenging, particularly when you handle it infrequently. It necessitates strict adherence to all formal procedures and the precise completion of all sections with complete and accurate data. However, it often occurs that you need to modify the document or add additional sections to fill out. If you need to enhance Get FL DR-191 2012 before submission, the most efficient method is by utilizing our robust yet straightforward online editing tools.

This all-encompassing PDF editing tool allows you to swiftly and effortlessly finalize legal documents from any device with internet access, make essential amendments to the template, and incorporate more fillable sections. The service allows you to select a specific field for each type of data, such as Name, Signature, Currency, and SSN, among others. You can designate them as mandatory or conditional and determine who should fill out each field by assigning them to a specified recipient.

Follow the steps below to enhance your Get FL DR-191 2012 online:

Our editor is a flexible, multi-functional online solution that can assist you in quickly and effortlessly refining Get FL DR-191 2012 along with other templates to meet your needs. Enhance document preparation and submission time while ensuring your documentation appears flawless without complications.

- Access the necessary sample from the directory.

- Complete the blanks with Text and utilize Check and Cross tools for the tick boxes.

- Utilize the right panel to modify the form with new fillable fields.

- Choose the fields according to the type of information you wish to gather.

- Designate these fields as required, optional, and conditional, and personalize their sequence.

- Allocate each field to a specified individual using the Add Signer function.

- Confirm that all required amendments have been made and click Done.

Related links form

Businesses registered in Florida are required to file an Annual Report to maintain an active status. This includes corporations, limited liability companies, and partnerships. Be sure to reference FL DR-191 for specific details on deadlines and requirements to stay compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.