Loading

Get Fl Dr-342000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-342000 online

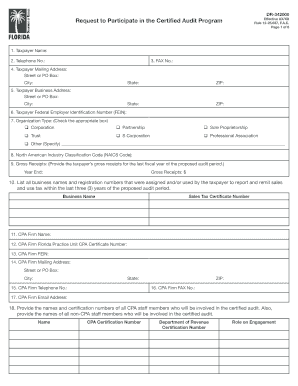

Filling out the FL DR-342000 form online can seem overwhelming, but with the right guidance, you can complete it comfortably. This guide provides step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to successfully complete the FL DR-342000 form.

- Click the ‘Get Form’ button to access the FL DR-342000 form and open it in your online editor.

- Begin by entering the taxpayer's name in the designated field. Ensure that the name matches the legal name as registered.

- Provide the taxpayer's telephone number, followed by the fax number if available. This information is essential for any necessary communications.

- Fill in the taxpayer's mailing address, including the street or P.O. box, city, state, and ZIP code.

- Next, input the taxpayer's business address, which should also include the street or P.O. box, city, state, and ZIP code.

- Enter the taxpayer's Federal Employer Identification Number (FEIN). This unique identifier is crucial for tax purposes.

- Select the appropriate organization type by checking the corresponding box, such as Corporation, Partnership, or Sole Proprietorship.

- Provide the North American Industry Classification Code (NAICS Code). If unsure, reference relevant resources or contact support for help.

- Enter the gross receipts for the last fiscal year of the proposed audit period, specifying the year-end date and gross receipts amount.

- List all business names and registration numbers used in the last three years for reporting sales and use tax.

- Fill in the CPA firm name, followed by the firm's Florida practice unit CPA certificate number and FEIN.

- Provide the CPA firm's mailing address, telephone number, and fax number.

- Enter the CPA firm's email address to facilitate communication.

- List the names and certification numbers of all CPA and non-CPA staff members involved in the audit.

- Indicate whether this request is to participate in the Certified Audit Program for a refund using a sampling method to establish the refund amount.

- Provide the tax and audit periods included in the certified audit, making sure they adhere to Department of Revenue guidelines.

- Attach a detailed list of services your firm has provided the taxpayer.

- Upload a copy of the firm's most recent System Review, as per the requirements outlined.

- Complete sections 23a through 23g for each applicable tax, answering Yes or No to each question.

- Attach a list of any outstanding liens, warrants, or Notices of Tax Action filed against the taxpayer.

- Attach a Power of Attorney (Form DR-835) for the qualified practitioner.

- Sign the application where indicated, ensuring that both the taxpayer and qualified practitioner have represented their portion.

- Review the completed application for accuracy, then save changes.

- Download, print, or share the completed form as necessary before mailing it to the designated address.

Get started today by completing your FL DR-342000 form online!

Related links form

Florida Rule of Criminal Procedure 3.111 B (1) relates to the assessment of defendant's mental competency to stand trial. It mandates that defendants undergo evaluations if there is reasonable doubt about their competency. Ensuring this procedure is followed is vital for a fair judicial process. Legal forms and information can be found on the uslegalforms platform, including guidance on the FL DR-342000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.