Loading

Get Fl Dr-456 1997-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-456 online

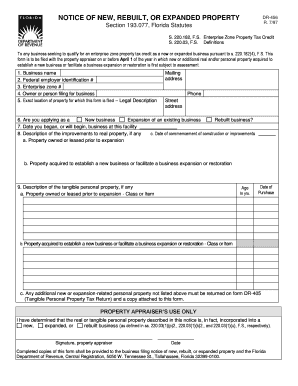

The FL DR-456 form, known as the Notice of New, Rebuilt, or Expanded Property, is essential for businesses seeking to qualify for an enterprise zone property tax credit in Florida. This guide will help you navigate the online process of completing this form efficiently.

Follow the steps to complete the FL DR-456 form online.

- Click the ‘Get Form’ button to obtain the FL DR-456 form and open it in your online editor.

- In the first section, enter your business name and federal employer identification number. These details are critical for identifying your business.

- Next, fill in your enterprise zone number, ensuring it matches the designated zone your business operates in.

- Provide the name of the owner or the person responsible for filing on behalf of the business. This ensures that the appropriate person is contacted regarding the application.

- Enter the exact location of the property for which this form is being filed, including the legal description. Correct property information is vital to the application process.

- Indicate whether you are applying as a new business, an expansion of an existing business, or a rebuilt business. This classification impacts the assessment process.

- Specify the date you started or will start business operations at this facility, as well as the date when construction or improvements commenced.

- If applicable, describe any improvements made to real property. Include details on whether the property was owned or leased before expansion.

- Provide descriptions of any tangible personal property associated with the business, including details such as class or item and the date of purchase.

- If you have any additional expansion-related personal property not already listed, you must report it on form DR-405, accompanying it with this form.

- Once you have filled out all sections, review your entries for accuracy. You can then save changes, download, print, or share the completed form.

Complete your FL DR-456 form online today to ensure timely submission!

Claiming 0 exemptions typically results in higher tax withholdings, which may be beneficial if you wish to avoid owing taxes at the end of the year. On the other hand, claiming 1 exemption allows for a slightly lower withholding amount. The decision ultimately depends on your financial goals, and using the FL DR-456 can guide you in making the right choice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.