Get Fl Dr-501t 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FL DR-501T online

How to fill out and sign FL DR-501T online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Documenting your income and submitting all essential tax documents, such as FL DR-501T, is the exclusive responsibility of a US citizen. US Legal Forms simplifies your tax management process, making it clearer and more efficient. You can locate all necessary legal templates and complete them digitally.

How to prepare FL DR-501T online:

Store your FL DR-501T securely. Ensure that all your accurate documents and information are properly organized, while being mindful of the deadlines and tax regulations established by the IRS. Simplify the process with US Legal Forms!

- Access FL DR-501T in your web browser from any device.

- Click to access the fillable PDF document.

- Begin completing the template field by field, guided by the prompts of the advanced PDF editor's interface.

- Accurately enter text and numbers.

- Select the Date field to automatically input the current date or adjust it manually.

- Utilize Signature Wizard to create your personalized e-signature and validate it in minutes.

- Consult Internal Revenue Service guidelines if you have further inquiries.

- Click Done to finalize the edits.

- Continue to print the document, save, or share it via E-mail, SMS, Fax, USPS without leaving your browser.

How to modify Get FL DR-501T 2012: personalize forms online

Utilize our all-inclusive editor to transform a basic online template into a finalized document. Keep reading to discover how to modify Get FL DR-501T 2012 online effortlessly.

Once you find an ideal Get FL DR-501T 2012, all that's required is to adapt the template to your preferences or legal stipulations. Besides filling out the editable form with precise information, you may need to eliminate some clauses in the document that are irrelevant to your situation. Conversely, you may wish to incorporate any missing conditions in the original document. Our sophisticated document editing features are the easiest way to correct and modify the document.

The editor enables you to alter the content of any form, even if the file is in PDF format. You can add and remove text, insert fillable fields, and make additional changes while preserving the original layout of the document. You can also reorganize the order of the form by modifying the page sequence.

You don't need to print the Get FL DR-501T 2012 to endorse it. The editor includes electronic signature capability. Most forms already have signature sections. Thus, you simply need to affix your signature and request one from the other signing party via email.

Follow this detailed guide to create your Get FL DR-501T 2012:

Once all parties sign the document, you will receive a signed copy that you can download, print, and distribute to others.

Our services help you save a significant amount of your time and minimize the likelihood of errors in your documents. Optimize your document workflows with effective editing tools and a robust eSignature solution.

- Open the desired form.

- Use the toolbar to personalize the template to your liking.

- Complete the form providing correct information.

- Click on the signature field and insert your eSignature.

- Send the document for signing to other signatories if necessary.

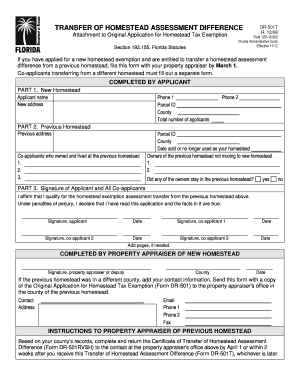

Qualifying for portability in Florida allows homeowners to transfer their homestead exemption benefits when moving to a new property. To be eligible, you need to have a prior homestead exemption and file the necessary paperwork, including the FL DR-501T. This process can help you retain tax benefits, making your transition to a new home smoother.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.