Loading

Get Fl Dr-514 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-514 online

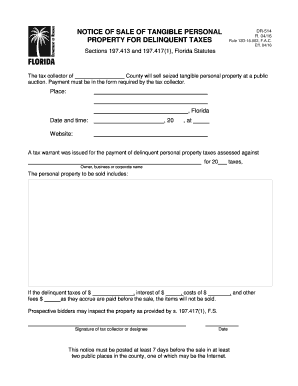

The FL DR-514 form is a vital document used for notifying the sale of tangible personal property due to delinquent taxes. This guide provides easy-to-follow instructions for filling out the form online to ensure compliance and clarity.

Follow the steps to fill out the FL DR-514 form effectively.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Fill in the first section with the name of the county where the sale will take place. Ensure accuracy to avoid legal issues regarding jurisdiction.

- Specify the place in Florida where the auction will occur, including all necessary address details.

- Enter the date and time of the auction. This information is crucial for potential bidders.

- Indicate the year for which the delinquent taxes are being assessed, as well as the name of the owner, business, or corporate entity responsible for the taxes.

- List the tangible personal property being sold. Provide a detailed description to ensure transparency.

- Include the amounts owed for delinquent taxes, interest, and any additional fees. This information helps potential bidders understand the financial requirements.

- Add the signature of the tax collector or their designee, along with the date of signing to validate the notice.

- Review all entered information for accuracy before proceeding. Corrections can prevent misunderstandings.

- Once you have completed the form, you may save your changes, download a copy, print it out for records, or share the document as needed.

Complete your FL DR-514 form online today to ensure a smooth sales process.

Related links form

Failing to file taxes in Florida can lead to penalties, interest on unpaid taxes, and potential legal action. Florida takes tax compliance seriously, and it is vital to file timely to avoid these issues. Using resources, including the information from FL DR-514, can help you stay informed, ensuring you meet all filing requirements with the aid of US Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.