Loading

Get Fl Dr-55 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-55 online

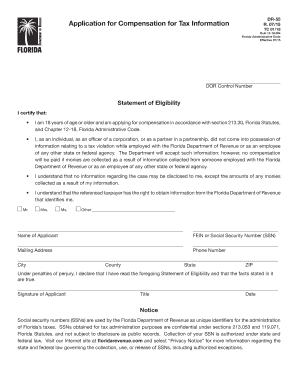

The FL DR-55 form is essential for individuals seeking compensation for providing tax violation information. This guide will walk you through each component of the form to ensure you complete it correctly and efficiently.

Follow the steps to confidently complete your application.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by filling out the Statement of Eligibility section. Confirm your age (18 years or older) and provide your name, FEIN or Social Security Number (SSN), mailing address, and phone number.

- Review the statement regarding the possession of tax violation information and ensure your understanding of confidentiality regarding your identity and the case.

- In the next section, declare the truth of your statements by signing the form. Include your title and the date.

- Proceed to the Noncompliant Taxpayer Information section and provide detailed information about the taxpayer who committed the violation, including their business name, doing business as (D/B/A) name, and business location.

- Fill out the Banking Information section by providing the business bank name, address, and the primary business account number.

- Lastly, summarize the violation in the Description section. If necessary, attach additional pages to elaborate on the details of the violation.

- Once you have completed the form, review all entries for accuracy. You can now save your changes, download, print, or share the form as needed.

Complete your FL DR-55 application online today for a smooth filing experience.

Related links form

The taxpayer rights advocate for the Florida Department of Revenue is dedicated to helping individuals understand their rights and responsibilities under Florida tax laws. This advocate provides assistance and can mediate disputes between taxpayers and the Department. Connecting with this advocate can also help navigate any issues related to FL DR-55, ensuring that you are well-informed about your rights.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.