Get Fl Dr-570ah 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-570AH online

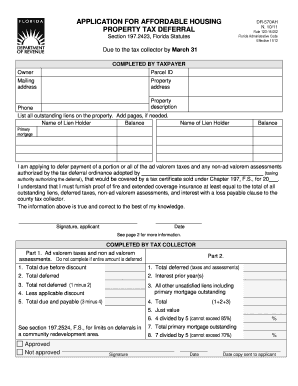

The FL DR-570AH form is essential for property owners seeking a tax deferral on ad valorem taxes and non-ad valorem assessments for affordable housing. This guide offers a step-by-step approach to filling out the form online, ensuring clarity and ease for all users.

Follow the steps to accurately complete the FL DR-570AH form online.

- Click ‘Get Form’ button to retrieve the form and open it in your preferred online editor.

- Begin with the 'Owner' section. Clearly enter your name as the property owner.

- In the 'Parcel ID' field, input the unique identifier for your property, which you can find on your property tax bill.

- Complete the 'Mailing Address' section with the address where you wish to receive correspondence.

- Fill in the 'Property Address,' ensuring it matches the location of the property for which you are applying.

- Provide a detailed 'Property Description,' outlining the type and features of the property.

- Enter your primary contact telephone number in the 'Phone' field. Optionally, provide a secondary contact number in 'Phone 2.'

- List any outstanding liens on the property. Include the 'Name of Lien Holder' and 'Balance' for each lien. If necessary, attach additional pages.

- Indicate the year you are applying for tax deferral by filling in the year on the specified line in the application.

- Sign the application in the indicated space to affirm that the information provided is accurate to the best of your knowledge.

- Enter the date of your signature in the provided section.

- Once all sections are complete, review your application for accuracy before saving the changes.

- Download, print, or share the completed FL DR-570AH form as needed based on your filing requirements.

Ensure you complete the FL DR-570AH form online before the March 31 deadline to secure your tax deferral.

Before claiming a Florida homestead exemption, ensure that you meet the eligibility requirements, such as owning and occupying the property as your primary residence. Complete the FL DR-570AH application accurately and gather necessary documentation, such as proof of residency. It’s wise to review specific county regulations, as requirements may slightly differ between locations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.