Get Fl Dr-700016 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-700016 online

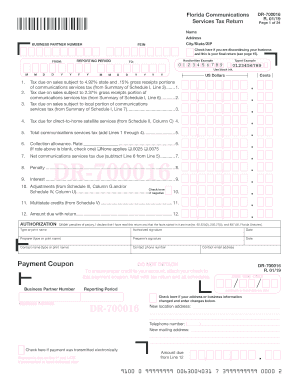

This guide provides detailed instructions on how to complete the Florida Communications Services Tax Return (Form DR-700016) online. Whether you are familiar with tax forms or new to the process, this step-by-step approach aims to support your understanding and ensure accurate completion.

Follow the steps to successfully complete the FL DR-700016 form online.

- Press the 'Get Form' button to access the FL DR-700016 form and open it in your chosen online editor.

- Fill in the business partner number, which is essential for identifying your account. This unique identifier should be displayed prominently on your Communications Services Tax Certificate.

- Enter your name, address, city, state, and ZIP code in the designated fields to ensure your information is correctly recorded.

- Provide your Federal Employer Identification Number (FEIN) if applicable. If you are discontinuing your business, check the appropriate box indicating that this is your final return.

- Fill out the reporting period by entering the start date and end date in the specified format (MM/DD/YYYY). This period reflects the timeframe for which you are reporting taxes.

- Calculate the tax due based on your taxable sales. Complete columns for tax due on sales subject to various tax rates, including the state and local portions.

- Add up the total communications services tax due from the various lines completed before. This reflects all the taxes owed for the specified period.

- Complete any necessary adjustments or credits, ensuring to properly record any local or multistate tax credits as applicable.

- Review the entire form to verify the accuracy of all entries. Ensure all data is correctly inputted to avoid delays or penalties.

- Once all information is confirmed, save the changes, and choose to either download, print, or share the completed form as required for your records or submission.

Start filling out the FL DR-700016 online today to ensure timely and accurate reporting of your communications services tax.

Get form

Related links form

The penalty for filing sales tax late in Florida generally starts at a percentage of the tax due, depending on how overdue your return is. Additional interest may accrue daily until full payment is made. It's crucial to maintain timely filings to avoid the complications linked to FL DR-700016, which helps ensure you're on track with your financial responsibilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.