Get Fl Dr-700016 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-700016 online

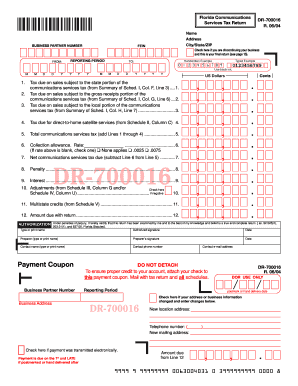

Filling out the FL DR-700016 is essential for businesses in Florida that provide communications services. This guide offers clear, step-by-step instructions to help you complete the form accurately and efficiently in an online format.

Follow the steps to fill out the FL DR-700016 online.

- Press the 'Get Form' button to access the FL DR-700016 form and open it in your chosen online editor.

- Begin by entering your business partner number at the top of the form. This unique identifier is assigned by the Department of Revenue and is crucial for processing your return.

- Fill in your business name, address, and the corresponding city, state, and ZIP code. Ensure that all information is accurate to avoid processing delays.

- Input your Federal Employer Identification Number (FEIN) in the specified field, which is necessary for tax identification purposes.

- If applicable, check the box indicating that this is your final return, which is necessary if you are discontinuing your business.

- Define the reporting period by filling in the beginning and ending dates for the sales you are reporting.

- Proceed to detail the tax amounts you owe. This includes entering the sales data from your records into the lines for state, gross receipts, and local taxes as presented on the form.

- Calculate the total communications services tax by adding the amounts from all applicable tax categories.

- Complete the authorization section by typing or printing the name of the authorized person, and obtain their signature on the form. Include the date of signing.

- Finally, review the completed form for any inaccuracies, then save your changes, download the form if needed, and prepare to submit it via your preferred online method.

Start completing your FL DR-700016 online today for seamless tax compliance.

Get form

Related links form

Mail from the Florida Department of Revenue may come as a notification about outstanding taxes, reminders for tax filings, or requests for additional documentation. Understanding the nature of this correspondence is important for maintaining compliance. Always address any issues raised in these letters promptly to avoid potential penalties. To help streamline responses to such communications, US Legal Forms provides valuable resources and templates.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.