Get Fl Dr-908n 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-908N online

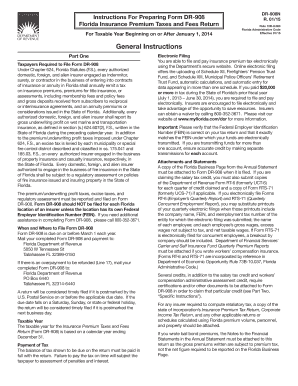

The FL DR-908N is an essential form for insurers operating in Florida, allowing them to report insurance premium taxes and fees due. This guide provides comprehensive, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out the FL DR-908N online.

- Click the ‘Get Form’ button to obtain the form and access it for filling out.

- Enter your name, address, Federal Employer Identification Number (FEIN), and Florida code at the top of the form. Indicate whether this is an Original, Amended, or Final return by checking the appropriate box.

- Provide the state of domicile, the location of your corporate books, and contact details for further inquiries, including phone number and email address.

- Fill in the taxable year for the insurance premium taxes and fees return, ensuring it is based on the calendar year ending December 31.

- Complete Section for Total Premium Tax Due from Schedule I, which calculates the applicable premium tax rates.

- Calculate any applicable credits against the tax in Section II and report on Line 2.

- Compute the net premium tax due by subtracting Line 2 from Line 1. Ensure this amount is not less than zero.

- Report any additional assessments such as State Fire Marshal Regulatory Assessments and surcharges that are required.

- Confirm that all attachments required, such as the Florida Business Page from the Annual Statement, are included.

- Finally, sign the form in the designated area, ensuring the original signature is affixed by an authorized officer. Check the form for completeness, and ensure all required fields and attachments are included before submission.

- Once completed, review your form one last time before saving changes, downloading, printing, or sharing the form as necessary.

Begin filling out your FL DR-908N online today to ensure compliance and timely reporting.

Get form

Related links form

The captive premium tax in Florida is a tax that applies to premium amounts collected by captive insurance companies. This tax helps regulate the insurance market and generate revenue for state funds. If you are considering a captive insurance approach, understanding the implications of the FL DR-908N form in relation to this tax is crucial. To navigate these complexities, resources such as US Legal Forms can provide valuable assistance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.