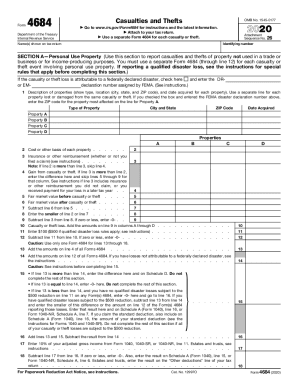

Get Irs 4684 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 4684 online

How to fill out and sign IRS 4684 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When individuals aren?t connected to document management and legal procedures, completing IRS documents can be quite nerve-racking. We recognize the necessity of correctly completing documents. Our online software proposes the utility to make the mechanism of completing IRS documents as elementary as possible. Follow this guideline to quickly and correctly submit IRS 4684.

The best way to complete the IRS 4684 on the Internet:

-

Click on the button Get Form to open it and start modifying.

-

Fill in all required lines in your file making use of our powerful PDF editor. Switch the Wizard Tool on to complete the process much easier.

-

Check the correctness of added information.

-

Include the date of submitting IRS 4684. Use the Sign Tool to make an exclusive signature for the record legalization.

-

Finish modifying by clicking on Done.

-

Send this file straight to the IRS in the most convenient way for you: through electronic mail, using digital fax or postal service.

-

You can print it on paper if a hard copy is needed and download or save it to the preferred cloud storage.

Making use of our powerful solution can certainly make professional filling IRS 4684 possible. We will make everything for your comfortable and quick work.

How to edit IRS 4684: customize forms online

Find the correct IRS 4684 template and modify it on the spot. Simplify your paperwork with a smart document editing solution for online forms.

Your day-to-day workflow with documents and forms can be more effective when you have everything you need in one place. For example, you can find, obtain, and modify IRS 4684 in one browser tab. Should you need a particular IRS 4684, it is simple to find it with the help of the smart search engine and access it immediately. You do not need to download it or search for a third-party editor to modify it and add your details. All of the instruments for productive work go in one packaged solution.

This modifying solution enables you to customize, fill, and sign your IRS 4684 form right on the spot. Once you find an appropriate template, click on it to go to the modifying mode. Once you open the form in the editor, you have all the essential tools at your fingertips. It is easy to fill in the dedicated fields and remove them if needed with the help of a simple yet multifunctional toolbar. Apply all the changes immediately, and sign the form without leaving the tab by simply clicking the signature field. After that, you can send or print your document if required.

Make more custom edits with available tools.

- Annotate your document with the Sticky note tool by putting a note at any spot within the document.

- Add required graphic components, if required, with the Circle, Check, or Cross tools.

- Modify or add text anywhere in the document using Texts and Text box tools. Add content with the Initials or Date tool.

- Modify the template text with the Highlight and Blackout, or Erase tools.

- Add custom graphic components with the Arrow and Line, or Draw tools.

Discover new options in efficient and simple paperwork. Find the IRS 4684 you need in minutes and fill it out in in the same tab. Clear the mess in your paperwork for good with the help of online forms.

Casualty and theft losses are limited to a $100 threshold per loss event (this works like a deductible) and an overall amount that must exceed 10 percent of your adjusted gross income (AGI) in order to take the deduction.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.