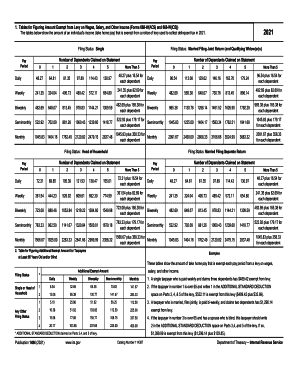

Get Irs Publication 1494 2021

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Bi online

How to fill out and sign Deduction online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

US Legal Forms is the leading publisher of professionally created papers and samples. Find a formal blank when you need it effortlessly. Don’t waste time on high-priced and demanding services. Just seek out your IRS Publ 1494 online using our trustworthy and vast library containing state-specific forms and templates.

Follow the basic walk-through prompts to receive your IRS Publ 1494 in no time:

- Access the website’s search engine or browse templates by category.

- Choose your state from the list and input your look-up phrase. This is crucial as a lot of states request distinct formats per their laws and regulations.

- Pick the document you need from the search results to see a description and free preview.

- Take a look at the IRS Publ 1494 preview. If offered, be sure to find the appropriate blank.

- Review more details about the material offered and check out any related electronic downloads. You may want additional documentation to support your current report.

- Forward the piece to the cart. You may instantly purchase the download or order a paper copy to your mailing address.

- Go to checkout or continue ordering.

When you don’t see the IRS Publ 1494 you are looking for, please forward a draft request. We’ve made US Legal Forms available for everyone. Our professionals prepare samples with detailed guidelines to ensure their accuracy, relevance and validity. We help millions of people preserve time and expense in legal charges.

How to edit Publication: customize forms online

Have your stressless and paper-free way of modifying Publication. Use our trusted online solution and save a great deal of time.

Drafting every document, including Publication, from scratch takes too much time, so having a tried-and-tested solution of pre-uploaded form templates can do wonders for your efficiency.

But modifying them can be challenge, especially when it comes to the files in PDF format. Luckily, our huge library features a built-in editor that enables you to easily complete and edit Publication without the need of leaving our website so that you don't need to waste your precious modifying your paperwork. Here's what to do with your form using our tools:

- Step 1. Find the required form on our website.

- Step 2. Hit Get Form to open it in the editor.

- Step 3. Use our professional modifying tools that allow you to add, remove, annotate and highlight or blackout text.

- Step 4. Create and add a legally-binding signature to your form by using the sign option from the top toolbar.

- Step 5. If the template layout doesn’t look the way you need it, utilize the tools on the right to remove, add more, and re-order pages.

- step 6. Insert fillable fields so other parties can be invited to complete the template (if applicable).

- Step 7. Share or send the document, print it out, or choose the format in which you’d like to download the file.

Whether you need to execute editable Publication or any other template available in our catalog, you’re well on your way with our online document editor. It's easy and safe and doesn’t require you to have particular tech background. Our web-based tool is set up to handle practical everything you can think of when it comes to document editing and completion.

Forget about the traditional way of working with your documents. Go with a a professional solution to help you simplify your tasks and make them less dependent on paper.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing gov

In this video guide, we will empower you with the right tips to easily fill in taxpayer. You’ll find help every step of the way. Take just a few minutes to significantly save time on paperwork.

Qualifying FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS Publication 1494

- biweekly

- dependents

- jointly

- IRS

- gov

- taxpayer

- qualifying

- exempt

- bi

- delinquent

- Taxpayers

- deduction

- publication

- spouse

- Examples

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.