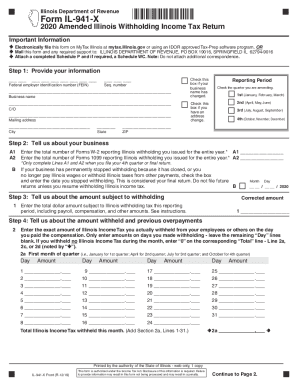

Get Il Dor Il-941-x 2020

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OVERPAYMENTS online

How to fill out and sign Ptin online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Registering your income and declaring all the crucial tax documents, including IL DoR IL-941-X, is a US citizen?s sole obligation. US Legal Forms tends to make your taxes management a lot more available and accurate. You will find any legal forms you require and complete them electronically.

How to complete IL DoR IL-941-X on the internet:

-

Get IL DoR IL-941-X within your web browser from any device.

-

Gain access to the fillable PDF document with a click.

-

Start completing the web-template field by field, following the prompts of the advanced PDF editor?s user interface.

-

Precisely enter textual information and numbers.

-

Press the Date field to put the current day automatically or alter it manually.

-

Apply Signature Wizard to design your custom e-signature and certify in seconds.

-

Refer to the Internal Revenue Service instructions if you still have inquiries..

-

Click on Done to save the changes..

-

Go on to print the record out, download, or send it via E-mail, text message, Fax, USPS without quitting your browser.

Store your IL DoR IL-941-X safely. You should make sure that all your appropriate papers and records are in are in right place while remembering the due dates and taxation regulations established with the Internal Revenue Service. Do it easy with US Legal Forms!

How to edit 70712191w: customize forms online

Forget a traditional paper-based way of completing 70712191w. Get the form completed and certified in minutes with our top-notch online editor.

Are you challenged to change and fill out 70712191w? With a robust editor like ours, you can perform this task in only minutes without having to print and scan documents over and over again. We provide completely customizable and simple form templates that will become a starting point and help you complete the necessary form online.

All files, by default, come with fillable fields you can execute once you open the template. However, if you need to polish the existing content of the form or add a new one, you can choose from a variety of editing and annotation tools. Highlight, blackout, and comment on the document; add checkmarks, lines, text boxes, graphics and notes, and comments. Additionally, you can quickly certify the template with a legally-binding signature. The completed form can be shared with other people, stored, sent to external programs, or transformed into any popular format.

You’ll never make a wrong decision using our web-based tool to execute 70712191w because it's:

- Easy to set up and use, even for users who haven’t completed the paperwork electronically in the past.

- Powerful enough to allow for multiple editing needs and form types.

- Safe and secure, making your editing experience protected every time.

- Available across different devices, making it effortless to complete the form from just about anywhere.

- Capable of generating forms based on ready-drafted templates.

- Compatible with various file formats: PDF, DOC, DOCX, PPT and JPEG etc.

Don't spend time completing your 70712191w obsolete way - with pen and paper. Use our feature-rich option instead. It provides you with a versatile set of editing tools, built-in eSignature capabilities, and ease of use. The thing that makes it stand out is the team collaboration capabilities - you can collaborate on forms with anyone, build a well-structured document approval flow from A to Z, and a lot more. Try our online solution and get the best value for your money!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing yyyy

In this video guide, we will empower you with the right tips to easily fill in mytax. You’ll find help every step of the way. Take just a few minutes to significantly save time on paperwork.

Preparer FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IL DoR IL-941-X

- a2

- a1

- idor

- preparers

- yyyy

- mytax

- preparer

- FEIN

- OVERPAYMENTS

- seq

- 2a

- ptin

- 70712191w

- 70712192w

- amending

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.