Loading

Get Nm Rpd-41373 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM RPD-41373 online

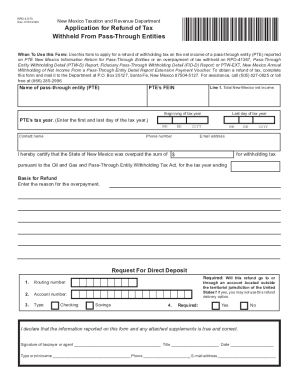

Filling out the NM RPD-41373 form online is crucial for applying for a refund of withholding tax on the net income of pass-through entities. This guide provides clear instructions to help users navigate through each section of the form efficiently.

Follow the steps to complete the NM RPD-41373 online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Begin by entering the name of the pass-through entity (PTE) and the PTE’s Federal Employer Identification Number (FEIN).

- Complete Line 1 by inputting the total New Mexico net income, including the beginning and last day of the tax year.

- Fill in the contact information: enter a contact name, phone number, and email address.

- Certify the overpayment amount by indicating the sum on the designated line for withholding tax.

- Under the Basis for Refund section, provide a brief explanation for the overpayment.

- Complete the Request For Direct Deposit section, filling in the routing number, account number, and type of account. Answer the question regarding whether the account is outside the U.S.

- Sign the form in the specified area, including the title and date of signature. Ensure to type or print the name clearly, along with phone and email address.

- Save your changes. You may then download, print, or share the completed form as needed.

Complete your NM RPD-41373 form online today to streamline your refund process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Franchise taxes are generally either a flat fee or an amount based on a business's net worth. New Mexico has a corporate income tax, which applies to traditional (C-type) corporations, and a franchise tax, which applies to traditional corporations and S corporations. ... total net income not over $500,000 = 4.8% tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.