Loading

Get Fl Rt-83sp 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL RT-83SP online

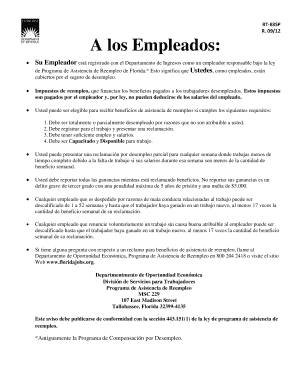

The FL RT-83SP form is essential for employees seeking unemployment assistance in Florida. This guide will provide you with step-by-step instructions on how to accurately fill out this form online, ensuring you understand each section and its requirements.

Follow the steps to complete the FL RT-83SP online

- Press the ‘Get Form’ button to obtain the FL RT-83SP form and open it for editing.

- Begin with your personal information. Input your full name, contact details, and social security number as specified. Ensure that all details are accurate to avoid processing delays.

- In the employment history section, list all your previous employers, including their addresses, phone numbers, and the dates you worked there. Be thorough, as this information is critical for your unemployment claim.

- Complete the section regarding your reason for unemployment. Indicate whether you are fully or partially unemployed and provide a detailed explanation of your situation.

- Fill out the income section, reporting all earnings during the weeks you are claiming benefits. Ensure complete honesty, as failing to report may lead to serious penalties.

- Review all the information entered for accuracy. Check for any errors or missing fields to prevent any delays in your claim.

- Once all sections are complete and accurate, you can choose to save your changes, download the form, print it, or share it as needed.

Complete your FL RT-83SP form online today to ensure your eligibility for unemployment assistance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Regular unemployment benefits in Florida do not amount to $600 a week and are determined by your earnings. The standard maximum benefit is lower, often around $300-$400 per week depending on your prior wages. If you are curious about potential benefits and updates, refer to the FL RT-83SP for the latest information on unemployment compensation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.