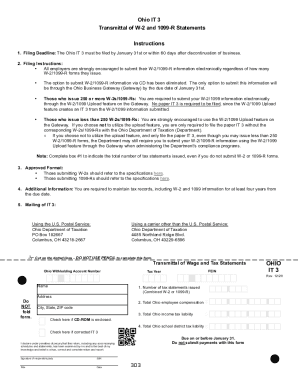

Get Oh Odt It 3 2020-2025

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Ohio wage garnishment forms online

How to fill out and sign Ohio form it 3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

These days, most Americans tend to prefer to do their own taxes and, furthermore, to complete forms digitally. The US Legal Forms web-based platform makes the process of preparing the OH ODT IT 3 easy and handy. Now it requires no more than 30 minutes, and you can accomplish it from any location.

How you can get OH ODT IT 3 easy and fast:

-

Access the PDF sample in the editor.

-

See the outlined fillable lines. This is where to place your information.

-

Click the option to select if you see the checkboxes.

-

Proceed to the Text icon and other powerful functions to manually customize the OH ODT IT 3.

-

Confirm all the information before you keep signing.

-

Create your distinctive eSignature by using a key-board, camera, touchpad, computer mouse or cellphone.

-

Certify your web-template electronically and place the date.

-

Click on Done proceed.

-

Save or deliver the file to the recipient.

Ensure that you have filled in and delivered the OH ODT IT 3 correctly in due time. Consider any deadline. If you give wrong details with your fiscal reports, it can lead to severe fines and cause problems with your annual income tax return. Be sure to use only qualified templates with US Legal Forms!

How to modify Ohio form wage: customize forms online

Remove the mess from your paperwork routine. Discover the most effective way to find and edit, and file a Ohio form wage

The process of preparing Ohio form wage demands precision and attention, especially from people who are not well familiar with this sort of job. It is essential to find a suitable template and fill it in with the correct information. With the proper solution for processing paperwork, you can get all the tools at hand. It is easy to simplify your editing process without learning additional skills. Locate the right sample of Ohio form wage and fill it out right away without switching between your browser tabs. Discover more instruments to customize your Ohio form wage form in the editing mode.

While on the Ohio form wage page, just click the Get form button to start editing it. Add your information to the form on the spot, as all the essential tools are at hand right here. The sample is pre-designed, so the work required from the user is minimal. Use the interactive fillable fields in the editor to easily complete your paperwork. Simply click on the form and proceed to the editor mode right away. Complete the interactive field, and your document is all set.

Try out more instruments to customize your form:

- Place more text around the document if needed. Use the Text and Text Box instruments to insert text in a separate box.

- Add pre-designed graphic components like Circle, Cross, and Check with respective instruments.

- If needed, capture or upload images to the document with the Image tool.

- If you need to draw something in the document, use Line, Arrow, and Draw instruments.

- Try the Highlight, Erase, and Blackout tools to customize the text in the document.

- If you need to add comments to specific document sections, click the Sticky tool and place a note where you want.

Sometimes, a small error can wreck the whole form when someone fills it manually. Forget about inaccuracies in your paperwork. Find the templates you need in moments and complete them electronically using a smart editing solution.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 2019 it 3

In this video guide, we will empower you with the right tips to easily fill in ohio it 3 form 2019. You’ll find help every step of the way. Take just a few minutes to significantly save time on paperwork.

2016 it 3 FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to ohio it 3 form

- ohio school district tax

- oh it 3 form

- oh it 3

- oh it

- oh form 3

- it 3 ohio tax form

- it 3 fill

- it 3

- form it 3 tax

- form it 3

- form 3 tax

- fbr form it 3

- 2020 oh it

- Discontinuation

- Taxation

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.