Get Ca Ftb 100 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 2020 100 tax online

How to fill out and sign Ca form 100 instructions 2023 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

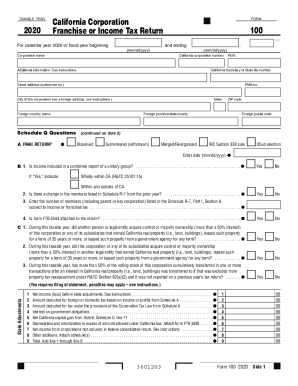

If the tax period started unexpectedly or maybe you just misssed it, it could probably create problems for you. CA FTB 100 is not the easiest one, but you have no reason for worry in any case.

Making use of our professional solution you will understand the right way to fill CA FTB 100 even in situations of critical time deficit. You just need to follow these easy recommendations:

-

Open the file with our powerful PDF editor.

-

Fill in all the information required in CA FTB 100, using fillable lines.

-

Include photos, crosses, check and text boxes, if you want.

-

Repeating information will be added automatically after the first input.

-

If you have any troubles, use the Wizard Tool. You will see some tips for much easier completion.

-

Do not forget to include the date of application.

-

Make your unique signature once and put it in the required fields.

-

Check the info you have filled in. Correct mistakes if required.

-

Click on Done to complete editing and select the way you will send it. You have the possibility to use digital fax, USPS or electronic mail.

-

You can even download the record to print it later or upload it to cloud storage like Google Drive, OneDrive, etc.

With our powerful digital solution and its beneficial tools, submitting CA FTB 100 becomes more practical. Do not hesitate to try it and have more time on hobbies instead of preparing files.

How to edit 2013 franchise: customize forms online

Have your stressless and paper-free way of editing 2013 franchise. Use our reliable online solution and save a lot of time.

Drafting every form, including 2013 franchise, from scratch requires too much time, so having a tried-and-true solution of pre-drafted document templates can do magic for your productivity.

But editing them can be problem, especially when it comes to the documents in PDF format. Luckily, our huge library comes with a built-in editor that lets you easily fill out and customize 2013 franchise without leaving our website so that you don't need to waste hours executing your paperwork. Here's what to do with your file utilizing our solution:

- Step 1. Find the required document on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Use our specialized editing tools that let you insert, remove, annotate and highlight or blackout text.

- Step 4. Generate and add a legally-binding signature to your file by using the sign option from the top toolbar.

- Step 5. If the document layout doesn’t look the way you want it, utilize the tools on the right to remove, add, and arrange pages.

- step 6. Insert fillable fields so other parties can be invited to fill out the document (if applicable).

- Step 7. Pass around or send the form, print it out, or select the format in which you’d like to get the document.

Whether you need to execute editable 2013 franchise or any other document available in our catalog, you’re well on your way with our online document editor. It's easy and safe and doesn’t require you to have special tech background. Our web-based solution is set up to deal with practical everything you can think of concerning file editing and execution.

Forget about the outdated way of dealing with your forms. Choose a more efficient solution to help you simplify your tasks and make them less dependent on paper.

Related links form

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.