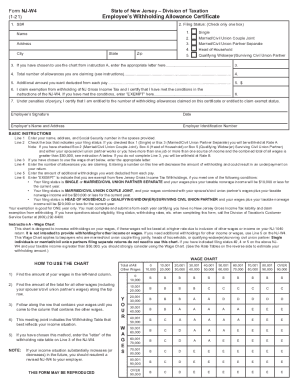

Get Nj W4 2021-2024

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Nj state w4 online

How to fill out and sign W4 withholding chart online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Today, most Americans would rather do their own income taxes and, in addition, to complete reports in electronic format. The US Legal Forms online platform makes the process of submitting the NJ DoT NJ-W4 simple and hassle-free. Now it will require a maximum of thirty minutes, and you can do it from any place.

How you can get NJ DoT NJ-W4 quick and simple:

-

Open up the PDF sample in the editor.

-

See the highlighted fillable lines. This is where to place your data.

-

Click on the variant to select when you see the checkboxes.

-

Go to the Text tool and also other advanced features to manually modify the NJ DoT NJ-W4.

-

Inspect every detail before you keep signing.

-

Create your exclusive eSignature by using a keyboard, camera, touchpad, computer mouse or mobile phone.

-

Certify your PDF form online and specify the particular date.

-

Click Done proceed.

-

Download or send out the document to the recipient.

Make sure that you have completed and delivered the NJ DoT NJ-W4 correctly by the due date. Take into account any applicable term. When you give incorrect data with your fiscal papers, it can result in significant charges and create problems with your annual tax return. Be sure to use only professional templates with US Legal Forms!

How to edit W4 form nj: customize forms online

Have your stressless and paper-free way of modifying W4 form nj. Use our trusted online solution and save a lot of time.

Drafting every document, including W4 form nj, from scratch requires too much effort, so having a tried-and-true solution of pre-drafted document templates can do magic for your productivity.

But modifying them can be problem, especially when it comes to the files in PDF format. Fortunately, our huge catalog comes with a built-in editor that enables you to easily fill out and edit W4 form nj without the need of leaving our website so that you don't need to waste your precious completing your forms. Here's what you can do with your document utilizing our solution:

- Step 1. Find the necessary document on our website.

- Step 2. Hit Get Form to open it in the editor.

- Step 3. Use our professional editing tools that let you insert, remove, annotate and highlight or blackout text.

- Step 4. Generate and add a legally-binding signature to your document by using the sign option from the top toolbar.

- Step 5. If the document layout doesn’t look the way you need it, use the tools on the right to remove, put, and arrange pages.

- step 6. Insert fillable fields so other persons can be invited to fill out the document (if applicable).

- Step 7. Pass around or send the document, print it out, or select the format in which you’d like to get the document.

Whether you need to execute editable W4 form nj or any other document available in our catalog, you’re well on your way with our online document editor. It's easy and secure and doesn’t require you to have special tech background. Our web-based solution is set up to deal with virtually everything you can imagine when it comes to document editing and completion.

No longer use conventional way of dealing with your documents. Go with a more efficient option to help you simplify your activities and make them less dependent on paper.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing w 4 form 2024

Learn more about how to complete nj w4 instructions rapidly and easily. Our simple step-by-step video guide shows and explains in detail the process of online filling and what to pay attention to.

How to fill out a w4 2024 FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to njw4

- sample of w4 form filled out

- new jersey w 4

- how to fill out a 2024 w4 form

- what is nj sdi tax

- new jersey withholding

- w4 form 2024 exemption from withholding

- new jersey state withholding form 2023

- nj state w 4

- employee's withholding allowance certificate how to fill out

- form editor

- form new jersey

- new jersey nj w4

- form nj w4

- w4 taxation

- form nj

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.